Overview of Minority Recapitalization

An attractive transaction option for business owners who want to continue to maintain control of a growing business

There are two types of recapitalization options for business owners—majority and minority. This article will focus on minority recapitalization.

What is Minority Recapitalization?

In a minority recapitalization, the investor provides debt and equity capital in exchange for 20-49% of the company. A transaction is typically structured with preferred equity that guarantees a return for the investor via a liquidation and dividend preference over common equity. The return can be a combination of cash coupon and deferred interest. The principal will be repaid after the senior debt has been fully amortized.

Typical Uses of Proceeds

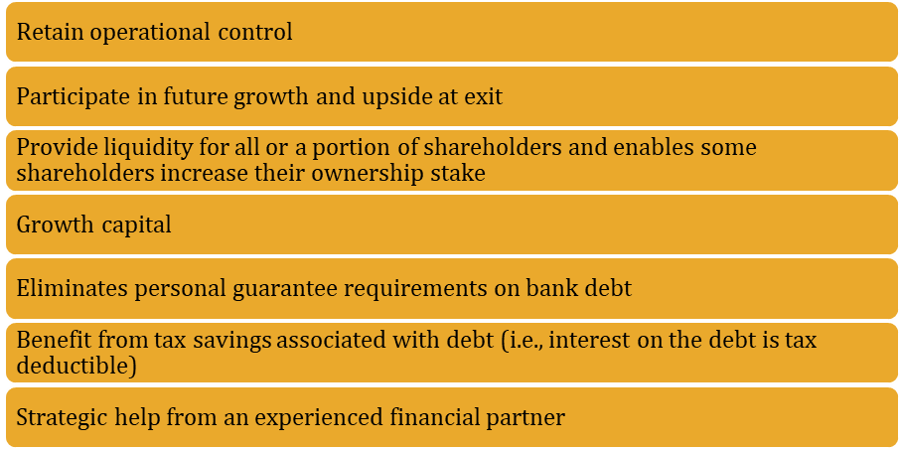

Business owners use the capital raised from a minority recapitalization in various ways, including: Benefits to the Business Owner

Benefits to the Business Owner

Minority recapitalization can be an attractive transaction option for business owners who want to continue to maintain control of a growing business. The key benefits to a business owner are:

Typical Minority Shareholder Rights

As mentioned above, a minority sale has significant benefits for business owners, but it is not free capital. Minority shareholders have various rights, including:

Alternative Funding Options

Aside from minority recapitalization, alternative funding options include debt and traditional private equity. However, there are some drawbacks to these two alternative options versus a minority recapitalization.