California AB 1771: Not a Laughing Matter but a Laffer Matter

In our advisory role to clients, tax considerations often come into play. Decision-making around wealth building is complex, and our thought pieces in the past have been popular resources. We consider the client’s goals, how to prepare for wealth and how to preserve your family legacy.

When we see major changes in legislation or other aspects of the tax environment, we often provide our commentary. Note, Colonnade does not provide tax advice.

Legislators in California are currently proposing AB 1771, also known as the California Housing Speculation Act. This potential change in capital gains on home sales would have a significant impact on the “fix and flip” industry, an industry where Colonnade has deep experience in our M&A advisory role. The main event of this proposed bill is an additional capital gains tax to the tune of 25% for homes sold within three years of purchase.

In this post, we cover:

- An overview of the proposed AB 1771

- A refresh on the Laffer curve

- Who’s at risk: Investors and the Fix and Flip industry

- Ideas for next steps

An overview of the proposed AB 1771

AB 1771 (the “Act”) proposes to add an additional 25% capital gains “speculation” tax from the sale of residential property in California if sold within seven years.

The proposed additional tax is a sliding scale that penalizes short term house “flips”, with the tax surcharge starting as high as 25% on net capital gains for sales made within three years of purchase:

- <3 years: 25%

- 3-4 years: 20%

- 4-5 years: 15%

- 5-6 years: 10%

- 6-7 years: 5%

- >7 years: 0%

The Act covers residential properties, which is somewhat unique; although, New York attempted such legislation in 2019 with its “New York State small home anti-speculation act” of 2019.

Legislators in California proposed the Act based on the concern that many California homes are purchased by investors, driving up prices. Alarmingly, there are no exemptions or carve-outs for equity earned through property improvement, and the narrowly defined exemptions and carve-outs will likely lump in consumer homeowners into the tax hike.

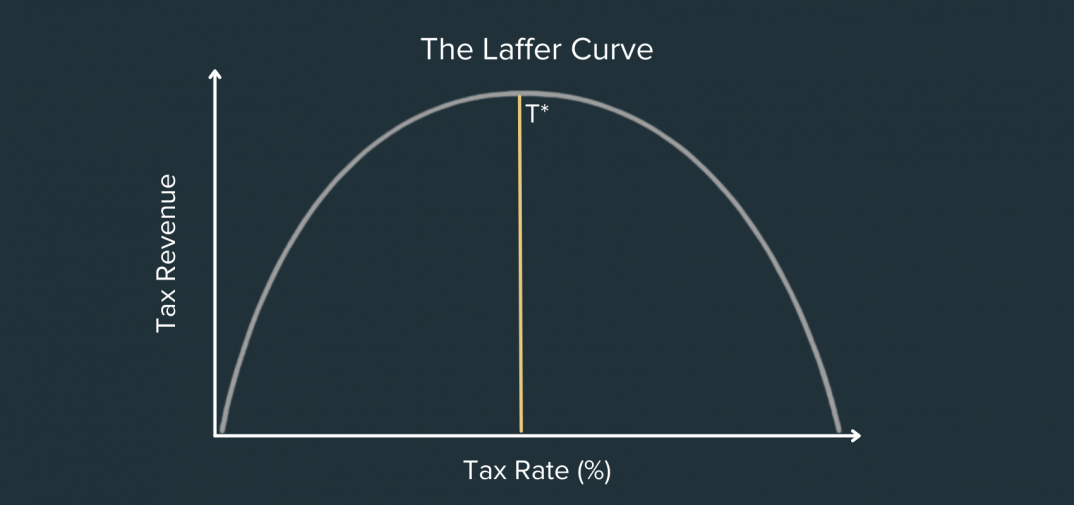

A refresh on the Laffer curve

You might remember the Laffer Curve from one of your macroeconomics classes. The Laffer Curve, developed by economist Arthur Laffer, shows an inverted-U-shaped relationship between tax rates and the amount of tax revenue collected by the government.

In other words, tax people too much, and they will stop working. The Laffer Curve has been criticized as being a tautology, a statement that is true by necessity or by virtue of its logical form. We like the visual reminder that government can go too far when raising taxes.

Who’s at risk: Investors and the fix and flip industry

The Fix-and-flip industry is a pillar of the $25+ trillion U.S. housing market that continues to rebound post-pandemic. The fix & flip industry represents approximately 5% to 7% of U.S. home purchases and serves the aging housing stock and end-user demand for refurbished properties. No one wants to live in run-down, moldy, and dated housing.

There are many nonbank lenders in the industry, including Anchor Loans, Dominion Financial, Genesis Capital, HouseMax, Lending Home, Lending One, Lima One Capital, Roc Capital, and Velocity. Aggregators and diversified mortgage lenders in this space include players such as Athas Capital Group, Beach Point Capital Management, MFA Financial, Finance of America, Redwood Trust, Peer Street, 5 Arch, and Toorak Capital Partners.

These lending institutions provide capital to investors seeking to buy, improve, and sell properties. There’s a real service provided by the investors and their financing sources. The counter-argument cries that the flood of institutional capital drives up prices for first time home buyers [of older properties that need work – our rhetorical emphasis].

The California legislation would have a significant impact on the fix & flip industry in California and would drive investors from the state. California’s housing stock and construction industry would suffer. While the Act might offer some relief from soaring house prices, the Act would still impact individual homeowners if they seek to sell in a short time frame.

Taxes do matter.

Ideas for next steps

- Learn more. The American Association of Private Lenders and many other organizations are offering educational webinars and forums to fight this legislation. This post from the AAPL offers videos from attorneys Think Realty, Geraci LLP as well as a zoom call covering changes from the legislation.

- Spread your concern. There are now hashtags you can use to mark content specifically about this legislation. Use #AAPL #YourAssociationAtWork #ChooseAAPL #privatelender #privatelending #AB1771 #LegislativeUpdate

- Take action. The AAPL provides sample letters to legislators and contact information.

If you are a company in the fix & flip industry and are considering a potential M&A transaction, set up a call with one of our team members to discuss how this legislation may impact valuation and your next steps.