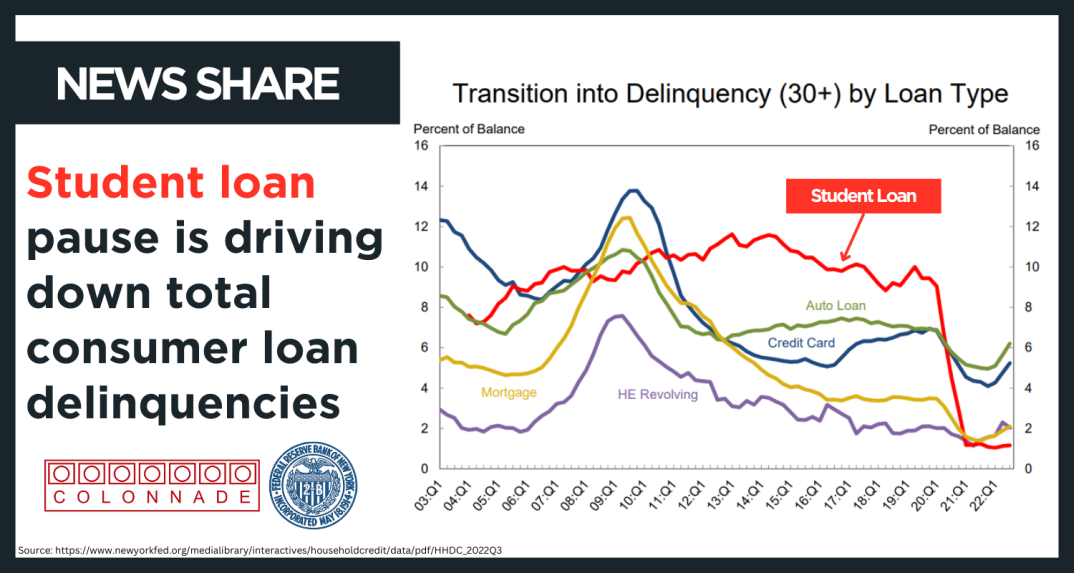

Student Loan Pause is Driving Down Total Consumer Loan Delinquencies

The recent Household Debt and Credit report by the New York Fed shows that the student loan pause is positively impacting total consumer loan delinquencies. Prior to the pause, approximately 10% of student loans would become 30+ days delinquent each quarter. Other types of consumer loans have returned to their pre-Covid delinquency levels, but student loans remain at a fraction of their historical levels. The lower rate of student loan delinquency has caused overall consumer loan delinquency to remain at historic lows of around 3%, down from over 4%-5% prior to Covid.