Potential Doubling of the Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners

Whatever your political affiliation, U.S. business owners are assessing the likelihood, timing, and impact of tax proposals from Vice President Biden and the Democrats if they win the White House and control Congress.

This blog post focus on potential changes to investment taxes and, in particular, the possibility of long term capital gains rates doubling to nearly 40% from current levels of 20%. Including the 3.8% net investment tax already in place, capital gains could be taxed at a higher rate than ordinary income in the new administration.

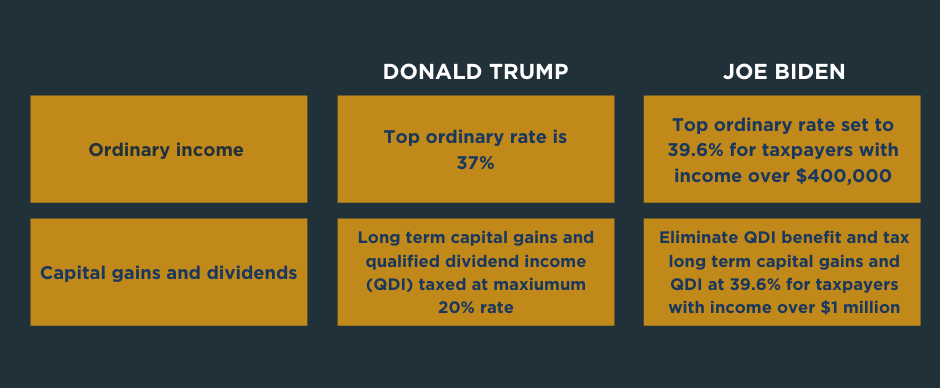

PROPOSED CHANGES:

Significant changes are expected to corporate tax rates, personal income tax rates, investment taxes, international taxes, IRS enforcement, the estate tax, and payroll taxes.

The table below outlines a comparison of Trump’s and Biden’s current positions on taxes.

Importantly, Biden is steering towards the Democratic consensus that capital gains and dividends for the wealthy should be taxed as ordinary income. Under Biden’s proposal, the top bracket for ordinary income taxes could increase to 39.6% (from 37.0% currently). Taxing capital gains and dividends at this upper rate – plus the net investment tax of 3.8% – would result in long term capital gains being taxed at a higher rate than ordinary income.

TIMING:

TIMING:

In a Biden-win scenario, any potential changes to the tax law are unlikely to come before the Spring of 2021. While a Democratic sweep in November is possible, the likelihood of an effective date of January 1, 2021, for significant changes to the tax law is unlikely – but, sadly, not inconceivable.

IMPACT:

There’s uniform consensus that a Biden win, particularly with a sweep in Congress, will result in significantly higher taxes on investments for wealthy Americans.

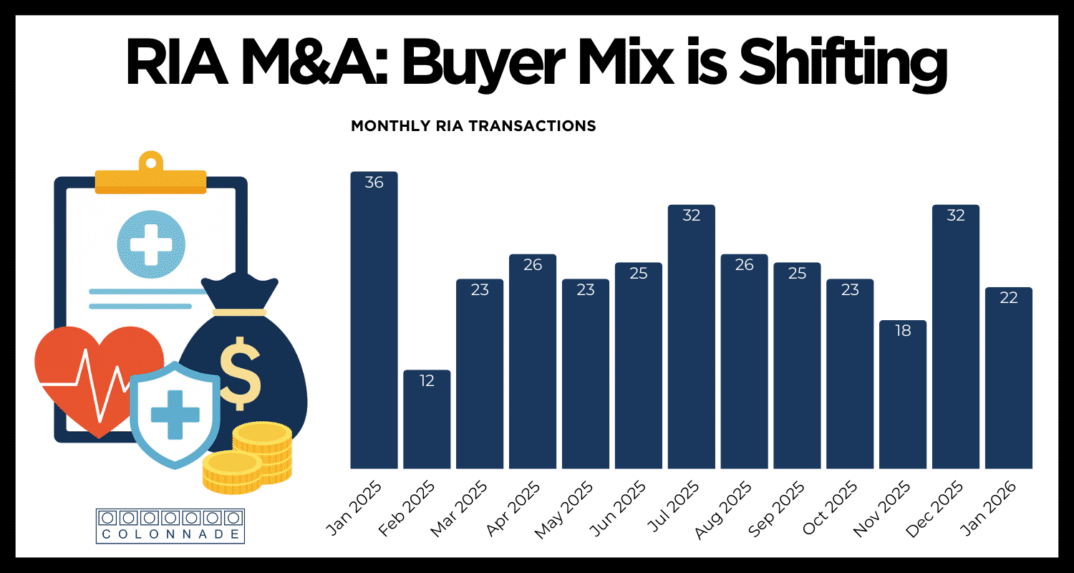

The strength of the U.S. stock market and the resurgence of M&A activity in recent months, coupled with potential changes to the tax law, are accelerating discussions around strategic options among business owners.

If you would like to discuss further how these potential changes are affecting the M&A markets and the opportunities and challenges for business owners, please contact us.