This episode continues with our “industry spotlight series” where we focus on specific trends and opportunities in middle-market M&A transactions.

Our previous episodes have covered four industries in which Colonnade has played a significant role as an M&A advisor to both buy-side and sell-side clients. We add F&I Agencies & Payment Plan Providers as industries where we deeply know the dynamics and players so as to provide exceptional service to clients who hire us to assist them in a transaction.

Colonnade has studied the F&I Agencies and Payment Plan Provider markets for the last 20+ years. We have worked on nearly 30 M&A transactions on the buy-side and the sell-side. We have gotten to know the industry players and the buyers. We’ve identified some high-opportunity M&A plays that could help to drive even more value, scale, and customer satisfaction in the industry.

SPOTLIGHT ON F&I AGENCIES (1:00)

In this first part of our episode, we answer the following questions:

- Where do F&I agencies sit in the F&I ecosystem? (1:00)

- What does a typical F&I agency look like? (7:00)

- What is going on in terms of M&A and what are the value drivers in the industry? (9:00)

- What is driving M&A transactions right now and what are some potential M&A plays? (12:00)

Where do F&I agencies sit in the F&I ecosystem and what value do they provide? (1:00)

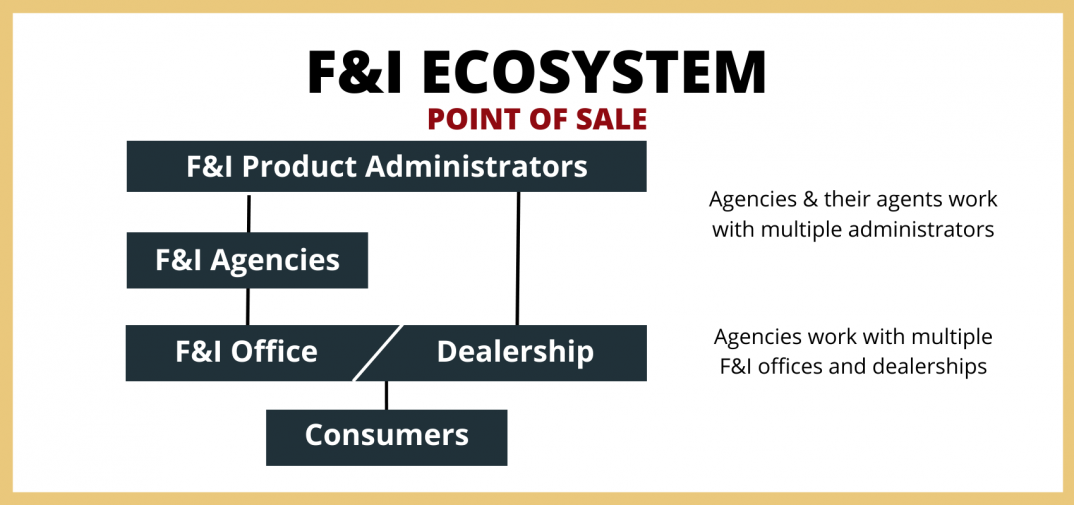

Gina: Between the F&I administrators and the F&I office and the dealership, there are F&I agencies. They are independent agencies with independent agents. They are like insurance agents. They bring together the product administrators and the dealers.

Gina: The agents have deep knowledge about the products they represent. They can train the F&I office on those products and how to sell the products. They also act as the middle man or the interface with the administrator. They are one distribution arm for the administrators, which makes them critical in the ecosystem. They are a valuable component of the overall F&I ecosystem.

Jeff: The F&I agency is a particular point in the value chain. It’s a differentiator. Some administrators sell to dealers through a direct sales force, others use F&I agents.

Gina: There are administrators who go direct to dealers, but most administrators also use independent agents. They may have a direct sales force, but they have independent agents also. The only sector where that seems to not always be the case is selling into independent dealerships. You tend to see more direct agents that are employed by the administrators selling into the independent dealerships.

Gina: An important component of what the agents do is help the dealership with reinsurance. Reinsurance is an important component of a dealership owner’s profits. For every contract, every F&I product that is sold, there is a reserve set aside for future claims. F&I agents are usually very fluid and educated in talking about reinsurance and making sure that the dealership has the right reinsurance programs. So they deal with reinsurance, they do training on products, they do training on how to sell products. They sometimes help with staffing in the F&I office, and they’ll help with some of the technology that is between the F&I office and the administrator.

Gina: F&I represents a third of a dealership’s profits. Everybody within the organization and affiliated with the organization is going to make sure that F&I runs smoothly.

What does a typical F&I agency look like? (7:00)

Gina: There are well over 100 independent agencies, and approximately 75%-80% of F&I agencies are less than 10 employees. There are very few large agencies. There are a few that are scaling, but there really aren’t many. There is only one national agency that comes to mind and that’s Vanguard (owned by Spectrum Automotive). Vanguard has been very acquisitive in building out its agent network.

We also see Brown & Brown, which is a P&C insurance brokerage. They’ve been acquiring F&I agencies over the last few years. I don’t know if they have a national footprint yet, but they’re probably getting pretty close. And then you have acquired a lot of small agencies.

Jeff: The Brown & Brown example is an interesting one that we’ve watched over the last five to six years as they’ve entered the industry. We’ve always thought their participation in the F&I agency world makes a lot of sense, given the parallels to the P&C distribution market.

What is going on in terms of M&A and what are the value drivers in the industry? (9:00)

Gina: We think that the M&A market for F&I agencies will continue to be hot in 2022.

(See Gina’s cover article in Agent Entrepreneur, 2022 M&A Predictions for F&I Agents)

Agent value is driven by a couple of different factors. One is diversification. One of the challenges for these small agencies, just like any small company, is having all of their eggs in one basket. An F&I agency may have one dealership group that represents 40% of sales. That is a gating factor to trading and getting the highest possible value. Agencies that have significant concentration, which I call greater than 15%, trade at a lower multiple than agencies that have little concentration.

Another value driver is size. We look at the number of W-2 employees (as well as financials).

Jeff: Important when you go to sell these companies: Who owns the dealer relationships? And what’s the risk of attrition in a transaction?

Gina: A lot of diligence needs to be done in these transactions to really understand the nitty-gritty of who, not just on paper but in practice, owns the relationships.

What is driving the M&A transactions right now and what are some potential M&A plays? (12:00)

Jeff: It sounds like an industry that could be rolled up further. Following the playbook of the P&C insurance distribution market, you got a lot of mom and pops out there and a few large players.

Gina: Both Brown & Brown and Vanguard Dealer Services (Spectrum Automotive) are rolling up agencies. The rest of M&A activity we see is not a roll up, but administrators buying agencies. National Autocare and Portfolio Group have been very inquisitive. There are many other administrators who bought one, two, three agencies, as they attempt to lock in their distribution channels.

Gina: There should be another roll up of F&I agencies. There should be a private equity firm that’s coming in here saying, “I’m going to put a hundred, $150 million to work and we’re going to leverage it. And we’re going to buy up 20 F&I agencies. We’re going to make a super-agency with national coverage.” That could be uber-successful for everybody involved. It just hasn’t happened yet.

Jeff: The folks that are acquiring are paying pretty high multiples, and that’s a challenge. Any new entrant would have to go in and go big pretty quickly. They’d have to find a platform that they can scale and put a lot of capital to work while holding their nose as they pay big prices upfront.

Gina: A lot of the M&A activity we have seen is with an older generation that is retiring. There’s also some leakage happening where the younger, talented, hungrier F&I agents are like, “I get it, I can do this.” They leave and go start their own agency. I think we’ll see that next-generation starting to trade in about a year or two.

Gina: I have one last point I want to cover about F&I agency M&A: what’s driving the activity.

First of all, there’s a lot of money looking for deals. There are private equity firms backing administrators that need to grow inorganically. But we also see a lot of M&A activity at the dealership level. They’re getting bigger. Big dealership groups are buying up other dealers, independent shops, and dealership groups. Every time one of those transactions happens, the agent that represents the target dealership is at risk of losing that client. Dealership M&A is driving F&I agency M&A.

I think that this is the question that keeps a lot of agents up at night: Are they one or several M&A transactions away from losing a significant portion of their relationships and their livelihood?

SPOTLIGHT ON PAYMENT PLAN PROVIDERS (18:00)

In this second part of our episode, we answer the following questions:

- How do payment plan providers add value to the auto F&I sector? (18:00)

- How big is the industry and who are the biggest players? (23:00)

- Why are payment plan providers a favorite industry of Colonnade? (25:00)

- What is going on in terms of M&A and what are the value drivers in the industry? (29:00)

How do payment plan providers add value to the auto F&I sector? (18:00)

Jeff: Payment plan companies came out of the ground around 20 years ago. They started as an offshoot of the insurance premium finance market, which we’ve talked about in a previous podcast.

Fundamentally, this market is designed to help consumers purchase F&I products cost-effectively.

Whether you’re in a dealership (point of sale) and the F&I person says, “This VSC is going to cost you $3,000” or whether you get a piece of mail about an extended auto warranty (aftermarket), once you get sold on buying the coverage, the questions is always: Do you want to write a check for three grand or do you want to finance it over two or three years?

In most cases, the VSC/extended auto warranty gets financed. That’s where these payment plan companies come in.

Jeff: At the dealership (point of sale), the payment for an F&I product typically gets rolled into the auto loan. It’s just one of the line items in the auto loan, and you (as the consumer) pay it off as you go. There are some payment plan providers that focus on point of sale at the dealership, allowing a consumer to finance the product outside the auto loan.

In the aftermarket, which is really where we see these payment plans flourish, it’s a different dynamic. If you’re on the phone with a direct marketer and you agree to buy the coverage, you can put 10% down and pay over 18 or 36 months, depending on the payment plan. Interestingly, they’re interest-free and cancelable at any time.

And as you continue to drive your car and assess the usefulness of the product, you can cancel it at any time. If you cancel it, all you do is call up the seller or the administrator and say, “I want to cancel my payment plan.”

In that case, you get a portion of your money back (the unearned premium). It works in a similar way to the insurance premium finance market. The contract is earned over the life of the product. If it’s a five-year product and you’re one year into it, you might get 80% of the money back. The payment plan company is indifferent because it will just get their pro rata share back from the administrator and seller.

The seller will sell the product to the consumer, and if they attach financing to it, the seller will collect the 10 or 15% down payment. The payment plan company will insert themselves and front the rest of the money to the administrator and to the seller.

The administrator has to front some money to the CLIP (1) provider, but the revenue to the seller and the admin fee gets fronted by the payment plan company.

Jeff: Our Industry Report on this sector goes into much more detail about the industry.

How big is the industry and who are the biggest players? (23:00)

Jeff: We estimate this is about a $5 billion a year originations market. There’s not good data. We’ve done a number of studies over the years and think that’s the size of the market. It grows with auto sales and the adoption of products. It’s grown considerably over the last several years.

There are probably 10 independent players in the market. There are just a small handful of large players.

The biggest players are PayLink, which is owned by Fortress and Milestone. Walco is the next biggest, and they’re growing nicely. This is the Walder team that previously ran Mepco and Omnisure, and they’ve started up a new finance company that’s growing quite rapidly. Mepco is a large player, they’re top three, that’s owned by Seabury.

There are other smaller players like Budco, Line 5. Service Payment Plan is a big company in the dealer space, again different dynamics but similar product offering.

PayLink, Omnisure, and Mepco really dominate the aftermarket space. Folks like Service Payment Plan dominate the dealer (point of sale) channel.

Why are payment plan providers a favorite industry of Colonnade? (25:00)

Gina: I love the payment plan business because it is so low-risk. What the payment plan companies do is hold a cash reserve on each funding in case the underlying consumer cancels. And that happens. There are a lot of cancellations in the direct consumer marketing of vehicle service contracts. As we’ve discussed before, it’s not because the contracts are bad contracts, but it’s because consumers actually have transparency. In the case of vehicle service contracts rolled into an auto loan, consumers don’t get a breakout every month of the components of their auto loan that they’re paying. They don’t see that 80% of your auto loan payment is for the car, 10% is for the vehicle service contract, et cetera, cetera. But when a consumer is financing or using a payment plan for a vehicle service contract in the aftermarket, they have complete transparency as to what that cost is for.

And if they decide as a household, they no longer need that product (they need to redeploy that payment to something else like their mortgage), they can cancel. The payment plan businesses have a cash reserve for this. So it is a very low risk business and has great returns.

Jeff: Some of these companies have several hundred million dollars of portfolio and each contract starts out at $3,000 and burns down. These are very granular portfolios. You’re not going to take a big loss on any particular contract. Unlike the insurance premium finance industry, the incidence or likelihood of fraud is negligible, and the risk here is quite low given the granularity.

We like the short duration of these assets. We like the low loss rates. Generally, these transactions are priced at a 15% to 20% unlevered return. They’re very high-yield. There’s no credit risk. We’re not doing anything with consumer credit risk. We really don’t care. We’re just managing relationships with sellers and administrators.

All those dynamics are favorable to this lending universe. I love this business. It’s a niche industry, $5 billion is not the $50 billion commercial P&C market, but it’s meaningful and growing.

What is going on in terms of M&A and what are the value drivers in the industry? (29:00)

Jeff: There really hasn’t been much activity as there’s a limited universe of players. Some of the administrators are vertically integrating and getting into the payment plan industry.

We worked on the initial sale of Mepco to Independent Bank almost 20 years ago.

We sold PayLink (which used to be called Warranty Finance Company) to Oxford Financial. It’s now owned by Milestone and Fortress.

Omnisure: Ed and Paul Walder started up that business from scratch and grew it to a couple hundred million dollars of receivables. We advised on the sale to Fortress.

PayLink and Omnisure merged in 2017 and put together two leading players in the industry.

The other important transaction to mention is Seabury’s acquisition of Mepco out of Independent Bank in 2017.

Most recently Walco has come out of the ground. Walco was started in early 2020 by Ed and Paul Walder again, starting up another competitor in the sector. They’ve grown considerably in recent years and are doing a great job building out that business.

We don’t see a ton of M&A activity per se, but it’s a really interesting market. Part of the challenge from an M&A perspective is that there has not traditionally been a deep bank buyer universe of this product and that confounds me a bit. For all the reasons we mentioned, this is a really interesting, dynamic asset class. It’s very similar to insurance premium finance, which has a number of large banks in the sector and a number that want to get into it. The collateral structure looks very similar, except that payment plan providers have higher yields, higher return on assets, and even lower losses. And there’s no fraud.

I think there’s a real opportunity for forward-thinking banks to embrace this asset class and do quite well with very little risk.

(1) A CLIP is a commercial liability insurance product that covers the contractual obligations of the insured. A full reimbursement CLIP would indemnify the insured commercial entity for all monies it expends to fulfill a contractual commitment.