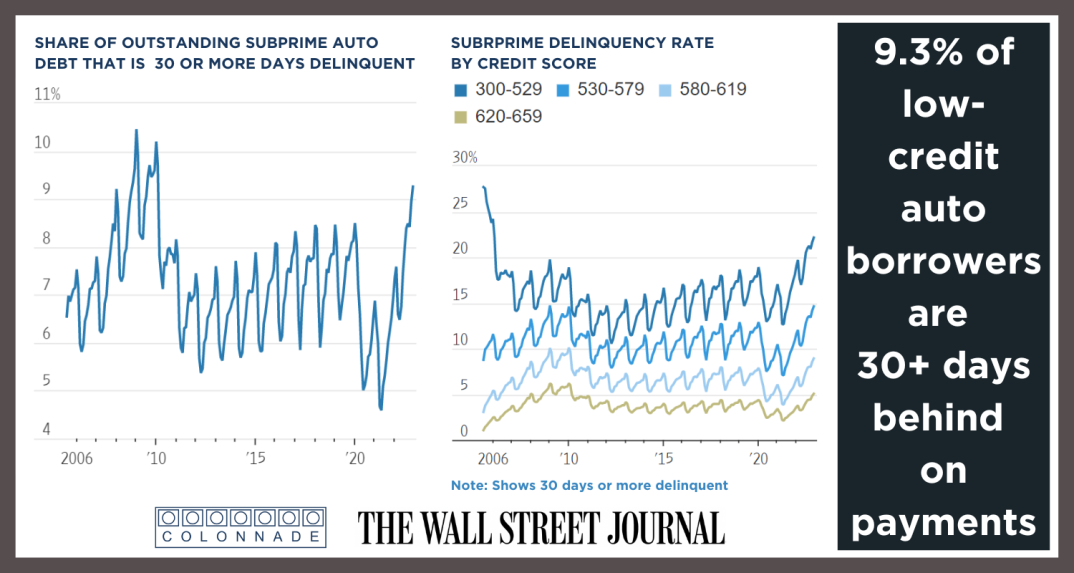

9.3% of Low-Credit Auto Borrowers are 30+ Days Behind on Payments

Despite signs that the US economy is regaining steady footing, a rising number of Americans have fallen behind on their car payments, according to a recent report by Moody’s Analytics. The stress in the auto loan market is primarily driven by borrowers with credit scores below 660, with those at the bottom of the credit spectrum experiencing the most difficulty keeping up with payments. The delinquency rate for consumers with credit scores between 300-529 was nearly 22.2%, and the 530-579 range approached 14.6%.

Increased personal savings throughout the pandemic combined with soaring car prices in recent years caused many consumers to take out large auto loans, leaving little flexibility in the event of financial difficulty. This has led to many borrowers now owing considerably more in loan payments than their vehicles are worth. Experts worry that the strain on the auto loan market could worsen if the U.S. heads into a recession, especially with the possibility of increased job losses. Nevertheless, Cox Automotive reports that although the number of people losing their cars to repossession rose 11% in 2022, it remains below pre-pandemic levels.