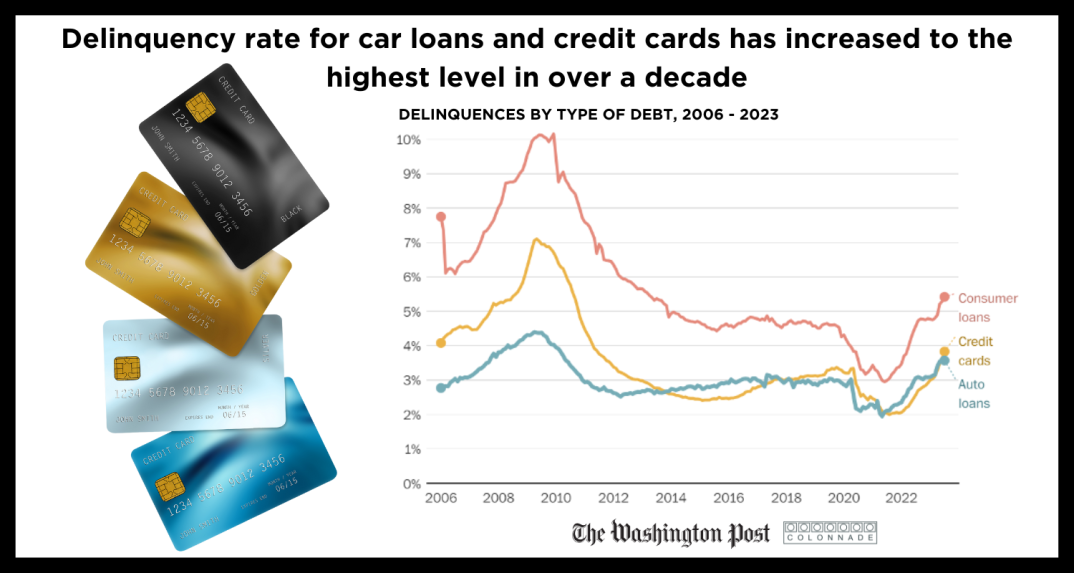

Delinquency Rate for Car Loans and Credit Cards Has Increased to the Highest Level in over a Decade

The delinquency rate for car loans and credit cards has increased to the highest level in over a decade, a sign of financial stress among consumers as inflation and rising interest rates eat into household budgets. Lower-income earners are disproportionally feeling the pain of inflation, as they have already exhausted the savings they accumulated during the pandemic. Lower-income borrowers are resorting to credit cards to hold their finances together. There are more credit card accounts open today than there were in 2019. For the first time in history, Americans’ total credit card debt topped $1 trillion, according to the New York Fed.

Source:

Washington Post