Earn Outs in M&A Transactions

Earn outs are a form of contingent consideration often used in deals, particularly middle market transactions. The buyer pays additional consideration if specific performance targets are achieved or events occur. Earn outs are used:

- to bridge valuation gaps (which widened in the recent sellers’ market),

- to motivate management in the short to medium term,

- to hedge risk in high-growth, competitive sectors such as software or tech-driven services, and

- to align interests in businesses that are reliant on the seller’s management to remain involved to execute on growth plans.

How often are earn outs used?

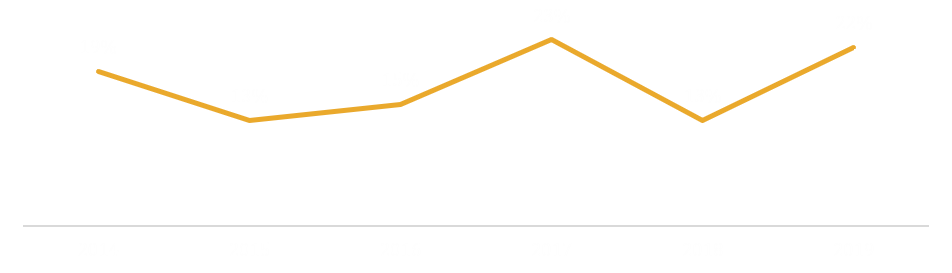

Over the past few years, earn outs have been used at varying rates. In 2019, 22% of transactions included an earn out. Due to the pandemic, the overall market sentiment is that earn outs will likely remain at current levels or increase as there is heightened uncertainty regarding performance during the recession.

How large are earn outs?

When used, earn outs represented an average of 41% of the transaction value in 2019. This component of transaction value has fluctuated over the last few years. As mentioned above, we expect the 2020 levels to remain around 40% and possibly higher due to the uncertainty that COVID-19 presents to the future performance of selling companies. It has skewed higher 2019 due to the large number of fintech and earlier stage bio and medtech deals.

How long are earn outs?

The terms of earn outs have lengthened to bridge the perceived valuation gap between buyers and sellers. Buyers are typically valuing companies off historical performance while sellers are looking for credit for future performance. In 2019, 46% of earn outs had a term of greater than two years compared to 31% in 2017.

In a situation where the buyer investment hold period is beyond the typical three to five years, such as for long lived funds and family offices, sellers may prefer an earn out to roll-over equity.

What are earn out performance targets?

Revenue is the most common performance target and is typically the one preferred by sellers. Earnings and EBITDA metrics, however, are the most contentious as there are more variables in the equation. Post-transaction, the seller no longer controls the company and may not be in the position to control the income statement. In 2019, earnings/EBITDA targets were only used in 8% of transactions, compared to 31% in 2017. Alternatives to financial-based targets include units sold, new customers accounts, and new channel partners are being used because they are easily measurable. The use of such targets has increased to 65% of transactions. Frequently, a mix of targets is used.

What deal covenants impact earn outs?

Sellers are at risk that even if an earn out target is achieved, it may not be paid due to financial constraints or buyer malfeasance. Ideally, an earn out would be structured with the future payment put in escrow at transaction close. However, it is rarely done and buyers typically fulfill the payout obligation with operating cash flow. The covenants in the purchase agreement can protect earn out payments.

A covenant to run the business in accordance with seller’s past practices could insulate the seller from the risk that the buyer changes operations resulting in missing targets. However, it was only used in 10% of transactions. A covenant to run the business to maximize earn out payments seems hopeful rather than practical to measure. It is included in 5% of transactions.

The best protection is to sell to a reputable buyer. Private equity firms are in the business of doing deals and the reputational damage from not paying a deserved earn out is significant.

Sometimes a second sale of the company happens before the time period for the earn outs expires. 22% of transactions include a covenant such that the earn out payment is accelerated upon a change in control. This covenant aligns management and owner incentives to not place achieving the earn out ahead of operating a company to maximize value in a sale.

For more information on earn outs, listen to Colonnade’s podcast, Middle Market Mergers and Acquisitions, episode 008: https://coladv.com/podcasts/008/