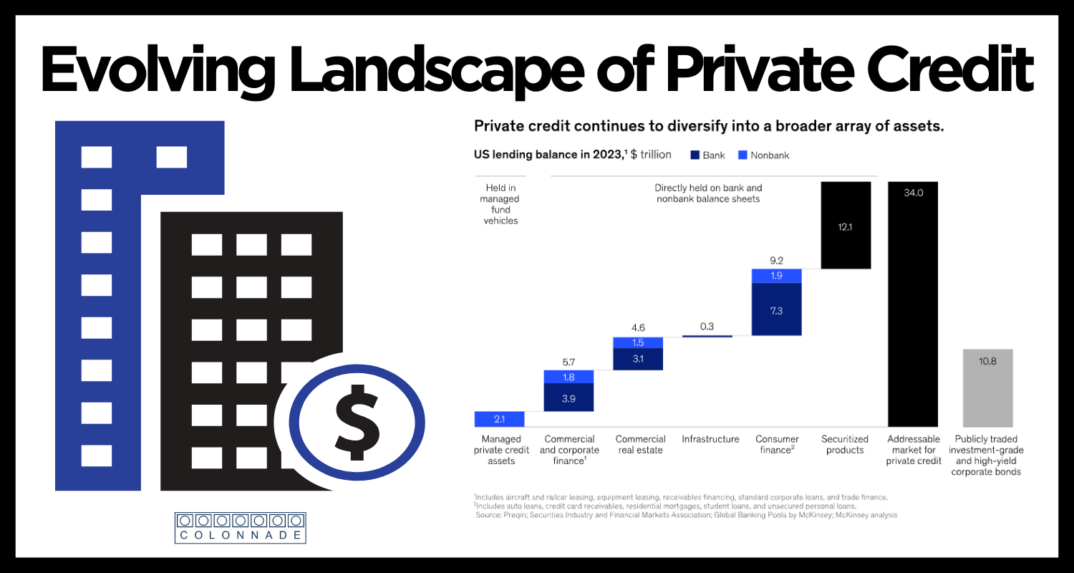

Evolving Landscape of Private Credit

Private credit has rapidly evolved into one of the fastest-growing sectors in finance, expanding nearly tenfold in the past 15 years to reach almost $2 trillion by the end of 2023. Although this represents a small fraction of the broader fixed-income market, private financing continues to outpace traditional banking and public alternatives in terms of performance.

The key drivers? Regulatory challenges faced by banks, the pullback from leveraged lending, and the expansion of private equity. As banks encounter increased competition from nonbank lenders, opportunities for collaboration are emerging. Banks have the potential to adapt by partnering with asset managers and insurers, focusing on origination while distributing risk—potentially leading to new business models, including open-architecture frameworks.

Looking ahead, up to $5-6 trillion in assets could transition to the non-bank sector over the next decade, contingent on three critical factors: interest rates remain above pandemic lows, yield assets perform within historical ranges, and current banking regulations persist. Key asset classes poised for this shift include asset-backed finance, high-risk commercial real estate, long-term infrastructure, and residential mortgages with high loan-to-value ratios.

As private credit continues to grow, it’s reshaping the financial landscape—unlocking new opportunities for innovation and investment. Those willing to adapt will not only gain a competitive edge but also contribute to a more resilient financial ecosystem.