Industry Overview – Insurance Premium Finance

Insurance Premium Finance – What is it?

The Insurance Premium Finance (“IPF”) industry facilitates the purchase of insurance policies for those who cannot afford to pay lump sum up-front premiums or those who wish to spread the cash flow burden out through the policy term. Premiums can be financed for commercial or consumer insurance policies, but it is more common for commercial.

IPF firms help drive growth in the insurance markets and deliver peace of mind for borrowers by providing accessibility to those who may not otherwise have the coverage they need.

How Does Insurance Premium Finance Work?

IPF lenders provide the funds to the carrier in exchange for security in the unearned premium and monthly interest payments from the borrower/insured. The unearned premium is refundable by the insurance carrier upon cancellation, exercisable through a power of attorney. Therefore, when properly structured, if the borrower stops paying, the lender can cancel the policy and receive any unearned premium. This structure shifts the loan risk from the actual borrower to the insurance carrier, providing much more security to the lender and allowing them to provide the loans at reasonable rates to the borrowers. Lenders also offer value through the supply chain by managing the billing and collecting aspects of the process on behalf of the insurance carriers.

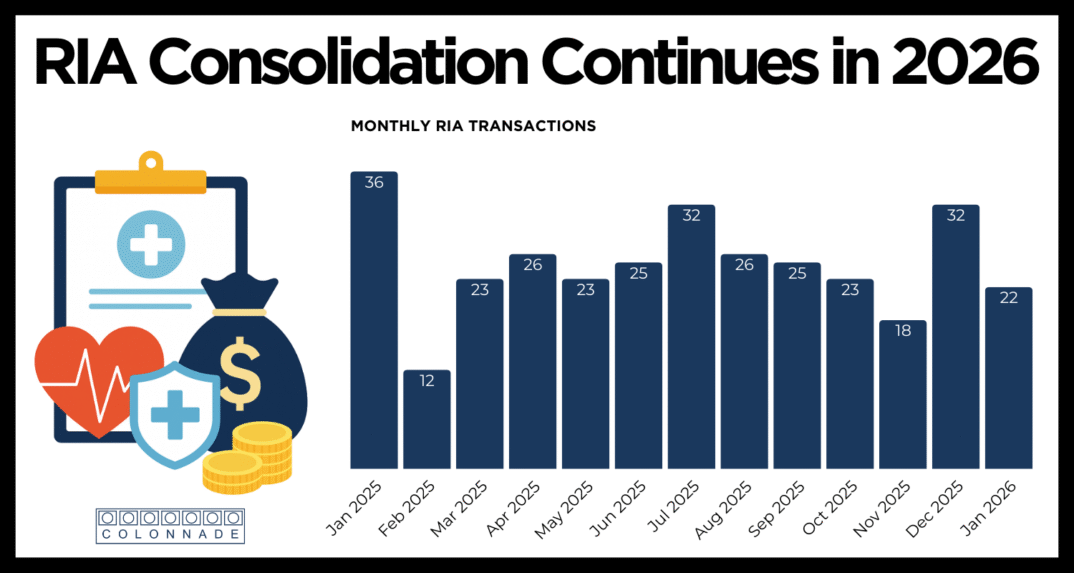

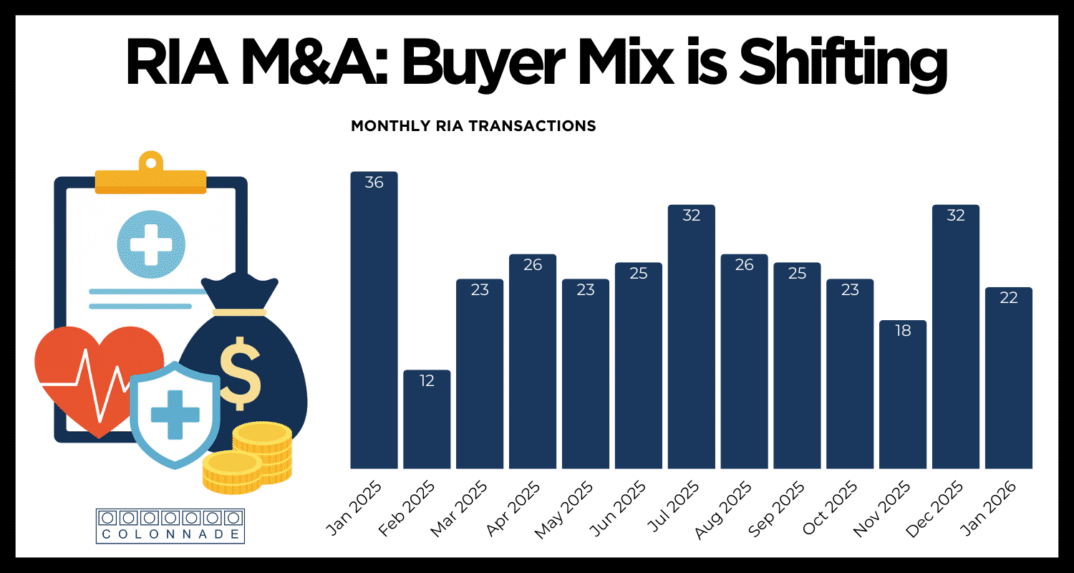

Consolidation in the Insurance Premium Finance Industry – M&A Activity Remains High

IPF loans are highly secured and relatively high-yielding, making them attractive to investors looking to grow or diversify a loan portfolio. Over the past few years, banks such as Trust, Wintrust, Texas Capital, and others have realized success in acquiring and integrating IPF businesses. This has provided a template for other financial institutions to diversify from more traditional commercial and consumer lending. As it stands today, there are approximately 1,000 licensed IPF lenders in the U.S., with only about 1.0% having any significant scale, and the market is highly concentrated, with the top 10 maintaining a market share of over 60%. Moreover, the breadth of the market has been greatly reduced since the early 2000s as consolidation has seen the small regional players rolled into larger platforms and other financial institutions.

Valuation of Insurance Premium Finance Businesses

Like most industries, the valuations of IPF firms will be heavily driven by size, scale, and growth potential. The financials and the historical originations will support the size and scale of the business, but identifying and articulating the growth drivers are vital in supporting an enhanced valuation. Besides size, scale, and growth; IPF-specific characteristics that drive valuation include:

- The firm’s relationships with insurance agencies it partners with, and

- The “bank-readiness” of the operations and back-office.

IPF originations are driven through the various agencies and brokers, so it is of the utmost importance that the firm maintains strong relationships with the agencies and brokers to ensure continued deal flow.

Being “bank ready” means having the systems, processes, and documentation that would allow for adequate diligence and seamless integration while also proving you would fit in as part of a larger, regulated entity.

When comparing your business to the market, there are three metrics used in valuing IPF firms:

- Multiples of book value;

- Premium to the loan portfolio (net receivables); and

- Multiples of pre-tax income.

It is important to note that multiples are subject to change with overall market conditions and can be enhanced by the value drivers mentioned above.

Colonnade has extensive transaction experience in the IPF sector and specializes in optimizing value for our clients pursuing a sale or capital raise for their business.

For more on the IPF Industry, listen to the Middle Market Mergers & Acquisitions podcast episode 018 here.

If you would like to discuss the IPF space further with Colonnade, please contact:

Jeff Guylay

Managing Director

312.425.8163

jguylay@coladv.com