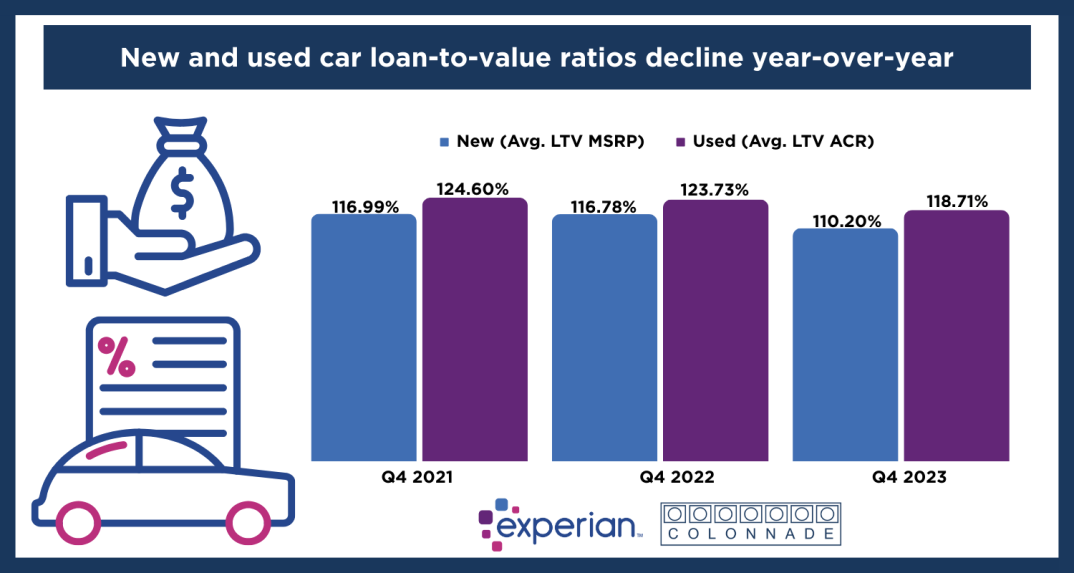

New and Used Car Loan-to-Value Ratios Decline Year-Over-Year

New and used vehicle loan-to-value (LTV) ratios fell 6.6% and 5.0%, respectively, in Q4 2023, according to Experian’s Q4 State of the Auto Finance Market. The average new vehicle MSRP rose to $41,703 in Q4 2023, up 3.6% year-over-year, while the average clean retail (ACR) value of used vehicles declined 2.0% year-over-year to $25,995. For new cars, the drop in LTV was largest for superprime borrowers, down 6.9% year-over-year, followed by prime at -4.6% and near prime at -3.1%. Superprime also saw the largest yearly decrease for used vehicles, down 5.6%, followed by deep subprime at -5.0%, then prime at -3.7%. As vehicle prices rose during the pandemic, many borrowers took on larger loans. This Q4 decrease in LTVs is a positive sign for many lenders, as higher LTV ratios are generally considered more risky.