Shifting Value Propositions in the F&I Ecosystem (Interview with Gina Cocking)

Colonnade’s CEO and Managing Director Gina Cocking was interviewed by Rebecca Chernek of Chernek Consulting on the Auto industry’s F&I Master Series.

Colonnade Advisors has deep experience in the automotive dealership services industry. Please see the pre-event interview series here for more information about Colonnade in the industry, M&A drivers, and more.

Colonnade Securities is a leading investment banking firm that has completed over $9 billion in M&A transactions for clients in the business and financial services industries.

Our firm has deep expertise in the automotive F&I industry and has advised many companies in the sector on strategic transactions. Please see our Quarterly Updates on the F&I industry here.

In this interview, Gina and Rebecca cover the following:

- How independent agencies/agents can continue to add value within an ecosystem that is experiencing a high volume of M&A activity

- Advice for agents with longstanding relationships with dealerships

- How buying behavior has shifted within the F&I ecosystem, and how industry players can best prepare for a successful future

- What agency owners want to know to be ready for a sale

How independent agencies/agents can continue to add value within an ecosystem that is experiencing a high volume of M&A activity

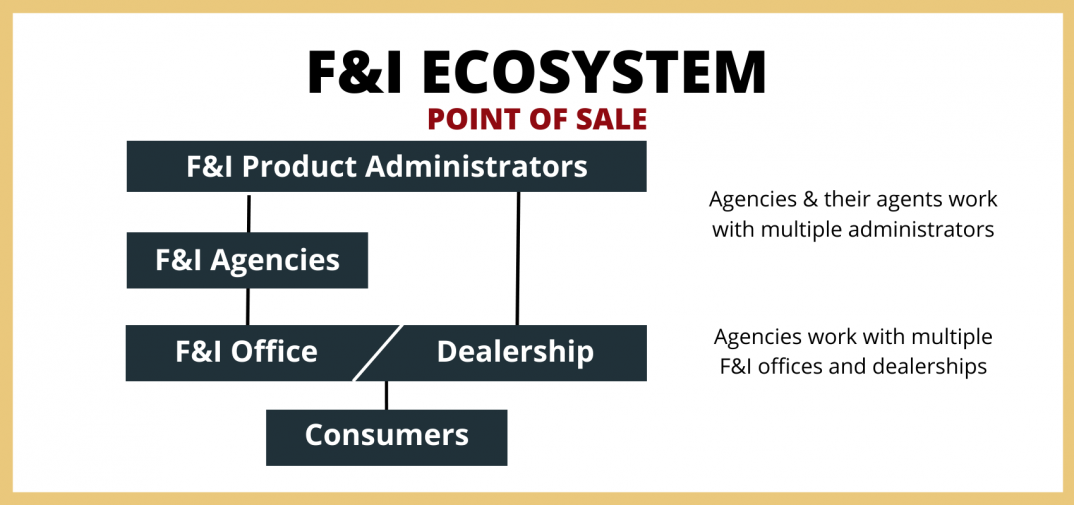

Within the F&I ecosystem, F&I agencies and their agents sit between the F&I administrators and the F&I office within the dealership.

Independent agents are like insurance agents. They bring together the product administrators and the dealers.

Gina: It’s a difficult environment for agencies. Agencies have kind of a dual set of threats coming at them. One, dealers are consolidating. The big keep getting bigger. There’s a lot of M&A happening in the dealership world. For an agent, it’s scary to think about. What happens when my number one client is acquired? Am I the agent that stays with the dealership group? Do I get pushed out?

The other thing that’s happening is there are a lot of agents that are being acquired and being part of a larger agent group, and it’s hard to compete against an agent group that has a larger footprint, a large geographic footprint, or one that’s working with larger dealerships. Larger dealership groups like to work with national providers. It can be tough for an independent agent to compete against that. Agents today can do a couple of things to prepare. One, they can build to scale their business, or two, they can sell and be part of a larger organization that can compete effectively.

Let’s talk about first, building to scale. As an agent, you can grow organically, meaning continue to bring on more people, more agents, land more dealership clients, and expand your geographic footprint. It’s actually a very difficult path to go down. Maybe outside funding is needed to do that. Maybe an agent says, “I can’t just go off and hire independent agents all over the place. I need to acquire another agency.”

If that is the path, then capital needs to be raised in order to fund those acquisitions. Advisors are probably needed to be hired to help complete those acquisitions, and you’re going to have attorneys involved. Or is it time for the agency to sell itself to a larger agency? That way, that agent group can continue to do well for its clients, continue to provide the same service and be there if that dealership is sold because they’re part of a larger agent group. I really see two paths for agents today to go down.

Advice for agents with longstanding relationships with dealerships

Gina: In order to retain the relationships that agents have and to be competitive if their dealership group’s being acquired, they need to provide just really strong services to that dealership group, that goes beyond just training on the products. That means training on systems. That means being an expert in reinsurance. It means talking about digital sales and how to best get in front of clients, from an F&I perspective, how to get in front of the vehicle buyers if they’re mainly doing digital retailing, or they’re shopping for cars online, and just showing up to sign the dotted line. How do you get the F&I office to be effective in that type of transaction?

Those agents that are able to have that additional value-add are definitely going to be more value-add to buyers. The way business was done 10 years ago, is not the same today. People don’t buy cars in the same way. Why would they buy F&I products in the same way?

How buying behavior has shifted within the F&I ecosystem, and how industry players can best prepare for a successful future

Gina: There are many points at which a person will buy an F&I product, and it’s not only inside the F&I office. By the time a consumer or a vehicle owner gets into the F&I office, they’re exhausted. They have decision fatigue. They just spent close to $40,000 on a vehicle. Now you’re asking them to spend more money. They’re like, “No”. It’s easier to say no than yes. That’s something that people always need to remember. It’s easier to say no than yes, no matter how compelling the argument is.

Training a sales team to sell F&I products and weave it into the conversation, for example, when they’re doing the drive around, that’s a great time, especially now with digital retailing. With digital retailing, people don’t need to spend as much time in the dealership. They’ve learned a lot online. They’ve been digesting information and looking at it on their phone, at their computer, on their iPad at night. But then they get into that car to do the test drive. That’s a great place to start talking about the products that are really wealth management products for that consumer before they walk into the F&I office. The pump is primed.

Across the board, maybe 55% of consumers buy vehicle service contracts in the F&I office. What about that other 45%? Either they were too exhausted to make that decision, it was too small of a time period for them to make that decision, or understand the product, or they weren’t followed up with. This is the whole reason why the aftermarket exists for vehicle service contracts.

For example, Carshield. Everybody sees the Carshield advertisements. That has been the best thing to happen to the F&I industry in a long time because Carshield has become a brand name. They are advertising what vehicle service contracts are. My mom now knows what a VSC is thanks to Ice-T. She gets it now. Now when people come into the F&I office, they may understand what the VSC is, but they know they can buy it aftermarket.

The dealership should really own that relationship. You don’t own that relationship by complaining about Carshield and saying, “Oh, those guys are taking away our business.” It wasn’t your business to have if you didn’t get it. The dealership and the F&I office should be following up with their consumers 30, 60, 90 days after the sale of the vehicle and try to sell them aftermarket contracts to the best of their ability. There are finance companies out there that will finance those products, even if they didn’t get into the auto loan.

Transparency is so important. Consumers want to be educated. We shouldn’t be paternalistic and tell consumers what they should buy. That doesn’t work anymore. We’re all smarter than that. That’s the beauty of the internet and Google. We all now have the tools to educate ourselves, and to purchase an asset like a car, which is the second-largest purchase a consumer will make, they should have complete transparency into the car and the products.

A sale of a vehicle is a relationship of trust. As a car buyer, you’ve built that relationship with the salesperson. I’m speaking to Joe, speaking to Joe, speaking to Joe, and I make my decision to buy this very cool car. I’ve talked to him eight times. We have all these text messages and emails going forward. Now, I would like you to meet Bob. You’re going to spend 10 minutes with Bob, and he’s going to make you spend 15% more on your car purchase. And you’re going to be like, “What?” They take advantage of that relationship and get more knowledge there.

Agencies can continue to add value within the ecosystem by adding more value to the dealership. Whether it’s through how they approach digital retailing, how they assist the dealership in selling more F&I products, or how they assist the dealer with successful follow-up to the customer, I believe that the agencies that continue to think of new ways to add value will be more valuable in a transaction. They’re doing business differently.

What agency owners want to know to be ready for a sale

Gina: If I’m an agency owner and I am thinking, “I’d like to sell my agency in the next couple of years,” there are a couple of things that I would focus on to get ready for a sale.

One, what is my value-added to the dealership? I must look to add value in every way we’ve been talking about including how we’re approaching digital retailing and how we are managing the lifelong customer relationship.

Two, how diversified am I? Agencies that have a lower concentration of dealership groups, not only rooftops but dealership groups, are more valuable. If an agency’s revenues are 20% or more from any dealership group, that’s definitely going to negatively impact the valuation of that agency. Diversification is key. Any agency that’s thinking about selling in a couple of years: you’ve got to work on bringing on more clients to have a diversified revenue stream. I can’t emphasize enough, dealership group versus rooftop. The decision-maker is at the group level.

Three: the number of employees. Are they 1099 employees, or are they your W-2 employees? As an agency, they need to be your W-2 employees to really get full value.

Watch the full 30 minute interview: