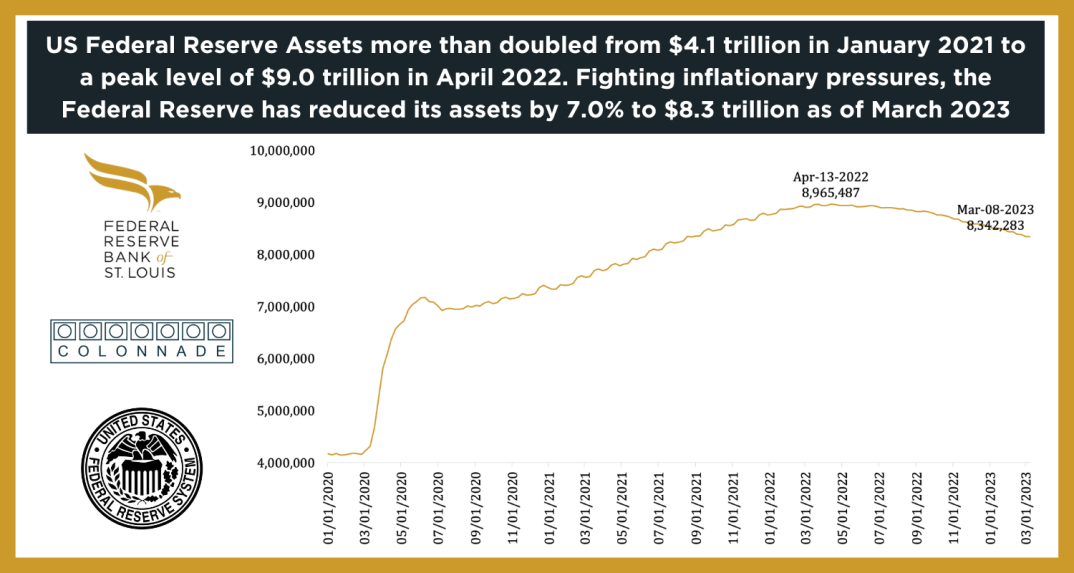

US Federal Reserve Assets More Than Doubled from $4.1 Trillion in January 2021 to a Peak Level of $9.0 Trillion in April 2022. Fighting Inflationary Pressures, the Federal Reserve Has Reduced Its Assets by 7.0% to $8.3 Trillion as of March 2023

Battling importunate inflationary effects, the US Federal Reserve is shedding assets, reducing the size of its balance sheet by 7.0% from peak levels observed in April of 2022 to current levels. This reduction is consistent with Jerome Powell’s statements during his March 8th Semiannual Monetary Policy Report to the Congress, in which he stated:

“With inflation well above our longer-run goal of 2 percent and with the labor market remaining extremely tight, the FOMC has continued to tighten the stance of monetary policy, raising interest rates by 4-1/2 percentage points over the past year. We continue to anticipate that ongoing increases in the target range for the federal funds rate will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In addition, we are continuing the process of significantly reducing the size of our balance sheet.”

Sources:

US Federal Reserve; St. Louis FRED