The Great Resignation’s Impact on M&A

Through October 2021, 38 million workers quit their jobs as part of what is being called the “Great Resignation.”

The term “Great Resignation” was coined by a Texas A&M University professor, Anthony Klotz, who predicted the mass exodus in May of 2021. This economic trend, in which employees voluntarily resign from their jobs en masse, has also been called the Big Quit.

Workers are leaving for higher wages, better conditions, or just a change. Some sources point to rampant stress, the shift to remote work, or shifting priorities in light of the pandemic.

While this disruption has been difficult, it is not as problematic as the elevated level of retirements. Over 2.5 million skilled, experienced people will not be returning to the workforce. One million include expected retirements, but 1.5 million were early retirements, according to recent research by Goldman Sachs.

The industries we cover at Colonnade Advisors are human capital-intensive, and having the right teams and “bench strength” is critical. Our clients are concerned about mass resignations and early retirements. They also wonder how employment gaps impact M&A transactions.

Colonnade’s CEO and Managing Director Gina Cocking had a cover article in Agent Entrepreneur magazine where she discussed the Great Resignation and the impact on Auto F&I Agencies. Please read the article here.

When our clients ask us how to mitigate these issues, our answer is to plan ahead.

We recently talked about the importance of planning ahead for retirement on our Middle Markets Mergers & Acquisitions podcast episodes 015 and 023.

When it comes to resignations and retirements, we remind our owner clients that their own departures could dramatically impact valuation in a transaction. Typically we see that a company needs to prepare five to seven years in advance of the owner’s planned retirement to start the sale process.

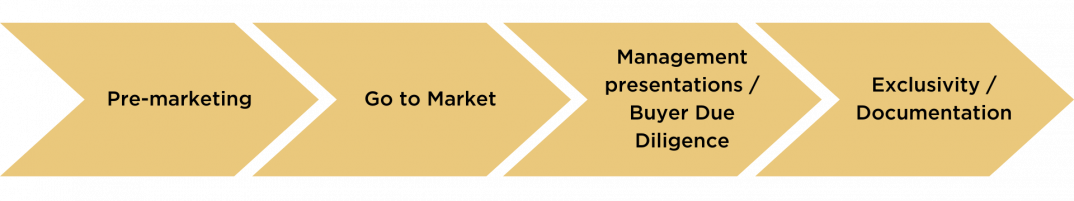

The process of selling your company is a long and intensive process.

Planning ahead may involve looking even decades out. Getting ready for the sale process includes building up the bench, getting the financial reporting in place, planning, systems, reporting, and much more. Having all these elements in place factors into the valuation that you can achieve.

Getting the best valuation may also involve taking on a financial sponsor to help institutionalize the business. The goal is to make the company more valuable through infrastructure and strategic investments over time.

This long-term strategy (investing in the business to grow it to increase its value and then sell it) has played out consistently over the years. Investments must be made in a disciplined and strategic manner so that they translate into higher value later on.

If you own a company and have some retirement goal in the not-too-distant future, taking on a financial partner to help you manage that transition and institutionalize the business to grow the value over time is a smart path. It takes time, patience, and planning. We talk in-depth about this process in episode 023 (The Market is Hot: Is it Time to Sell?).

If you have questions about the next steps for your company, please feel free to reach out to one of our team members.

Sources: