In this episode, Gina Cocking and Jeff Guylay continue their conversation around deal structure.

Today we explore earn outs, a form of contingent consideration in which the buyer and seller share both the risk and upside/reward based on the future performance of the business.

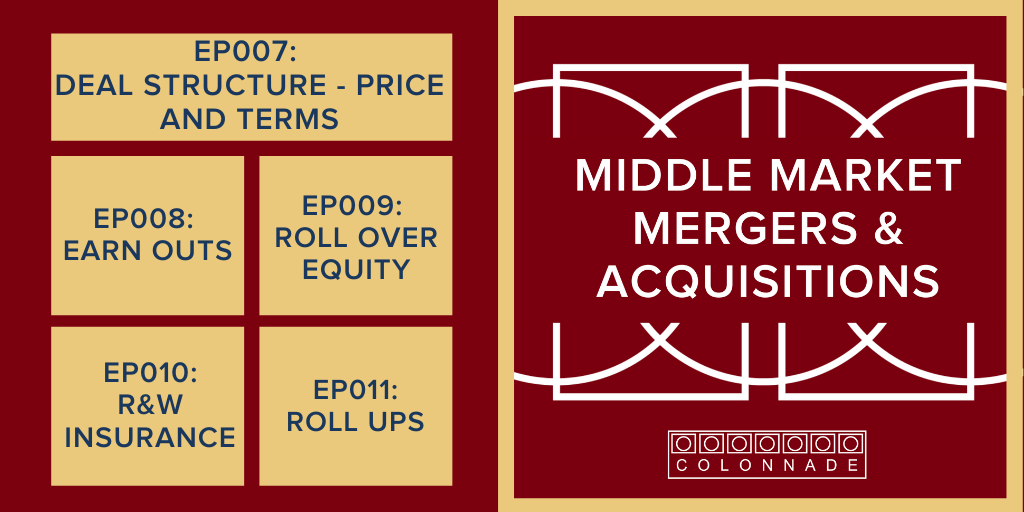

Other episodes in our series about deal structure include price and terms, roll over equity, R&W insurance, and roll ups.

Earn outs have been used in about 15% to 25% of middle-market M&A deals in the last few years, and the use of this financial tool is expected to increase during and after the COVID-19 crisis.

The episode features guest Mark Kopidlansky of Munsch Hardt. Mark shares an attorney’s perspective on earn outs and what tactics work best for buyers and sellers.

In this episode, Colonnade Advisors addresses the following questions as related to earn outs:

What is an earn out? (00:49)

Jeff: “Contingent consideration – that’s the simplest way to think about it.”

Why are earn outs put in place? (01:37)

Jeff: “It’s a risk-sharing mechanism. They shift risk back to the seller. Earn outs can be an important part of getting transactions done.”

What metrics are used in earn outs? (02:28)

Gina: “In my experience, the buyer always starts at the bottom of the income statement, EBITDA or net income. The seller prefers a metric

at the top line level, like revenue or units sold. We end up with a disconnect, and that’s where negotiations come in to determine the best metric to use.”

Are earn outs standard in middle market M&A transactions? (03:46)

Jeff: “In a perfect world, we agree on a price, and the buyer pays in cash in full at closing. No hold back, no escrow, no earn out; but that’s not the way that a lot of our deals happen in the middle-market. Earn outs are frequently used (and becoming increasingly so) in middle-market transactions.”

Is it possible to structure the earn out with multiple metrics? (06:29)

Jeff: “You could key the earn out to a top-line metric, and then gate the earn out provided that earnings don’t fall a certain level.”

Who should have control of the company during the earn out period? (06:51)

Jeff: “In nearly all earn out situations, the seller is still in control of the business.”

Are there instances where a seller would want a longer-term earn out period? (08:25)

Jeff: “Some clients want a really long earn out because they think that there’s a big pathway ahead. And they think there’s a huge opportunity.”

What percentage of deals have earn outs historically? (12:37)

Gina: “15 to 25% of deals have earn outs as a component.”

How will the COVID-19 pandemic impact earn outs used in future transactions? (12:37)

Gina: “My guess is that earn outs will be a tool that is deployed more consistently across deals because there is so much unknown (both downside and upside).”

What happens when earn out discussions come up towards the end of a transaction? (13:33)

Jeff: “When an earn out concept comes up late in the game, it’s really a question of whether both parties want to get the deal done?”

If the earn out equals one-times earnings in year one post-transaction, wouldn’t the seller just keep holding the company and pay themselves that earn out? (15:38)

Gina: “That gets back to the conversation around the seller’s objectives. [Remember you may have already pocketed 7-8x earnings upfront.]”

What percentage of the total transaction is typically structured through an earn out? (16:59)

Jeff: “In general, an earn out is a small percentage of the total transaction. It’s often 20 or maybe up to 30% of the purchase price. 25% on average.”

Can earn outs go towards other holdbacks? (17:26)

Jeff: “Oftentimes the earn out will mitigate or minimize any escrow or hold back.”

What is the sell-side advisor’s role in reviewing the buyers’ bids?

Jeff: “As advisors, we draw on our experience in looking at term sheets and work with our seller clients to think four steps ahead, like in a chess game. Thinking through what the likely outcomes will be based on experience with working with particular buyers or just on transactions in general.”

Gina invites Mark Kopidlansky, from Munsch Hardt, to share an attorney’s perspective on earn outs and what tactics work best for buyers and sellers.

What suggestions do you have from a legal perspective around structuring earn outs? (22:13)

As a seller:

- Negotiate some sort of release from restrictive covenants

- Pursue a consent to jurisdiction provision in your hometown

- Know that if you continue in a management role, and something goes wrong, a buyer is a lot more likely to negotiate with you to keep you happy

- Include in your employment agreement a clause that says you can quit for good reason if you are not paid under the purchase agreement/earn out

- Seek out a clause so that, if you quit for good reason, you are released from any non-compete agreement

Featured guest bio and contact information:

Mark Kopidlansky

Email: mkopidlansky@munsch.com

Mark Kopidlansky has extensive experience assisting principals and other participants in a variety of sophisticated corporate, securities and business transactions, including mergers, acquisitions and dispositions involving privately-held and publicly-traded companies, with a focus on high-end, middle market clients and transactions.

His representation of middle market clients consists of counseling clients in general corporate and commercial matters including with respect to joint venture and partnership agreements, shareholder agreements, buy-sell agreements, executive and employee stock option plans and compensation packages, consulting agreements, severance agreements, distribution agreements, covenants not to compete and confidentiality agreements, and license agreements.

Mark also has significant experience in capital market and capital raising transactions, including representing issuers in public and private equity and debt financing and refinancing transactions (including initial public offerings and other registered offerings, private placements and venture capital financings). His experience includes counseling clients with respect to corporate governance, disclosure and other securities law compliance matters (including compliance with SEC reporting and disclosure requirements).

Some of his most notable experience includes serving as lead counsel on two award-winning transactions – the D CEO and Association for Corporate Growth 2016 “Midsize Deal of the Year” ($25 MM to $149 MM) and the M&A Advisor’s 2015 “Energy Deal of the Year” (up to $100 MM).

For more information on earn outs, read Colonnade’s blog post discussing earn outs in M&A transactions.