M&A volume is at an all-time high, multiples are up, and there is much capital under pressure to be deployed by various buyer groups.

Is it time to sell your company?

Colonnade Advisors’ Managing Directors Gina Cocking and Jeff Guylay explore this question in detail along with a discussion of:

- Favorable macro trends in the M&A markets and the availability of capital

- Four reasons company owners consider a transaction

- Ten reasons companies partner with a financial sponsor

Favorable macro trends in the M&A markets and the availability of capital (3:00)

Gina: 2021 was an incredible year. In the United States, M&A deals hit $1.2 trillion. That’s a new record, 64% higher than 2019. There were 8,621 deals that were done in 2021, an increase over 2019 of 50%.

The pandemic accelerated some retirements as well (read about The Great Resignation’s Impact on M&A here).

Jeff: The capital gains plan that was being put forth by Biden accelerated a lot of sales. Rolling into 2022, there’s still some talk about raising capital gains and other tax rates, but much of that pressure is off.

Gina: Valuations are high. Colonnade does a quarterly update on M&A activity. We report on multiples industry-wide. We saw in Q3/2021 the average multiple for companies selling was 10.2x. That is a high multiple.

Gina: In the United States alone, private equity firms have a lot of dry powder, meaning capital that’s not yet invested but they need to invest, of $827 billion. That’s a lot of money to put to work. More than 20% of that money is from private equity funds that raised money in 2018 or earlier. Private equity firms usually have a time horizon to deploy capital. It used to be five to seven years, but the investment cycle has shortened to closer to two to four years. For those vintages from 2018 and earlier, they’re going to be working hard to get that money out the door.

Jeff: SPACs (Special Purpose Acquisition Companies), similar to private equity firms, have a limit on the amount of time they have to put their capital to work. We saw several hundred billion dollars worth of capital raised in the public markets through SPAC vehicles. Those are generally even on shorter timeframes, typically two years or even less in some cases. The SPAC craze we’ve seen over the last 18-24 months has added fuel to the fire and accelerated this trend of increasing valuations and demand for good properties.

Gina: The availability of capital will continue to increase in 2022. There are a large number of private equity funds that are raising money. In 2021, 389 funds in the United States raised over $300 billion of capital. In 2022, that high level of capital raising is expected to continue. One of the drivers is the limited partners’ allocation to private markets. I read that CalPERS, the giant California pension plan, is increasing its private market allocation from 8% to 13%. A lot of that capital will be going to the middle market.

Jeff: The increase in allocation to private equity investments adds more to this heap of capital we see waiting to be deployed.

Gina: Private debt funds have been growing over the past decade, too. They’re fueling some of the private equity M&A activity that we’re seeing. In 2021, 111 funds raised $111 billion of private debt capital.

Jeff: You end up with better price and terms for the sellers. It’s an interesting market today. You’ve got the trifecta here between the sponsors and the debt markets and the strategics. There’s a ton of capital sloshing around the system looking for good deals.

Four Reasons Company Owners Consider a Transaction (15:25)

1. It’s time to take some chips off the table and diversify

Gina: For a founder of a company or a family-owned business, chances are the entrepreneur or the business owner has a significant amount of their wealth tied up in the illiquid asset that is their business. So taking some chips off the table – getting some liquidity – can be appealing.

Jeff: We haven’t seen a pandemic in 100 years, and we haven’t seen a major correction in a decade. Maybe now is a good time to de-risk a little bit. Perhaps take some of that capital and invest in the public markets or otherwise.

2. A partner, owner, or investor wants to retire or exit

Gina: Here’s the challenge: if you’re a business owner and you want to retire in 2022, it’s difficult to just sell your company in 2022 and retire. Your departure could impact the valuation. (See our blog post on the Great Resignation). Typically a company needs to prepare five to seven years before the owner’s retirement to start the sale process.

Jeff: Another common trigger point for us is when minority partners or an aging founder, somebody who has helped fund the business and is often silent, want to do something else. They just need the capital to affect that transition. It allows for a new financial sponsor to come in, take a meaningful ownership stake and help build up the company for the next sale.

3. It’s time to do something else

Gina: Founders of companies are a different breed. They are entrepreneurs. They live to build and grow. They have all these ideas going through their heads.

Jeff: We see horizontal business moves in many of the related businesses we work in, like auto warranty (VSCs) and home warranty. An entrepreneur may have built up a great VSC company, and then they identify an opportunity to exit the auto side. They might have already had success in the home warranty segment, so they focus there and build a new business.

Learn more about the Vehicle Services Contract Administrators and Home Warranty in our Industry Spotlight episodes.

4. The company needs growth capital

Gina: A company needs more capital to grow, make strategic acquisitions, and accelerate growth. Bringing on growth equity, which could be a minority stake, is more common. We’re seeing private equity funds that had traditionally only made majority investments or acquisitions also making growth equity investments in companies.

Jeff: In the last five-plus years or so, financial sponsors have broadened their mandate. More investors are doing minority deals for these purposes. They see significant growth opportunities and want to partner with management teams to help grow the business.

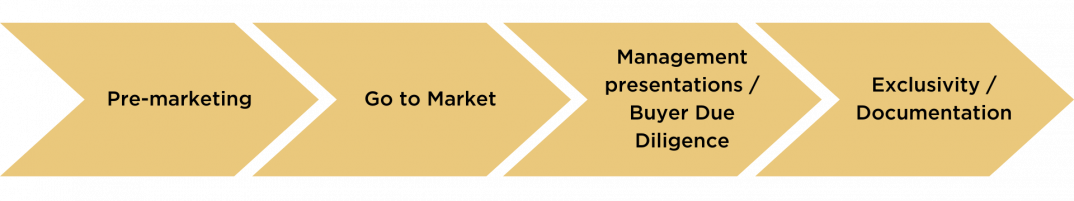

If you are thinking about selling your company, don’t miss our podcast series on the process of selling your company. This four-episode series breaks down the process and integrates the commentary of a CEO who has recently been through the sale of her company.

Ten Reasons Companies Partner with a Financial Sponsor (30:00)

We conclude our conversation by talking about the ten reasons companies partner with a financial sponsor:

1. Capital

Gina: Companies are selling a majority stake in their business or even raising growth capital because they cannot compete adequately anymore. They need more access to capital. Competitors are growing at a more rapid rate and have more money available to them because they’ve already brought on investors.

Jeff: It’s tough for these smaller folks to compete because the financial sponsors plant their flag with these big platform investments and continue to roll up other related companies. So the small guys just can’t compete.

Gina: They don’t have as much capital. They don’t have the same geographic reach. It’s harder to retain employees. To gain distribution, they need to have a larger geographic footprint. They can’t just be in one city or one state. They need to be regional. They need to be super regional. They need to be national. To experience that kind of growth, they need access to capital.

2. Business acumen

Gina: Private equity teams often come from consulting and investment banking backgrounds, having successfully built and run businesses themselves. They have seen a lot of deals. They’ve seen what works and what’s best in class. A private equity partner will bring its industry’s perspective to their partner company.

3. Operational experience

Gina: Institutional investors will bring operational experience, too. They can help with talent management and get the right people in the right seats. They can help establish dashboard metrics, monthly financials, reporting packages, and daily performance monitoring.

4. A network of connections

Gina: The investors will also leverage their extensive networks to bring resources to the table. They have industry experts that they’ll add to the board. They can help on the salesforce side and improve productivity by providing introductions to potential customers or partners.

5. Long term partnerships

Jeff: In this hypercompetitive market for deals, it’s interesting to see how much these buyers have to sell themselves to our clients and us as the preferred buyer because it’s not just about price. It’s not just about terms. It’s about the long-term partnership.

6. Strategic planning and prioritization

Gina: The institutional investor will help a company prioritize initiatives, establish clear plans and assist in the disciplined execution of those plans. Institutional investors can help in strategy. They can identify and build long-term goals and plans. They can refine the business strategy in marketing, products, and service.

7. Assistance with add-on acquisitions

Gina: The private equity firm often has M&A experts or partners with advisors like us. They help identify targets. They will figure out the financing, they will execute the deal, and they’ll help with integration.

For a business owner to do an acquisition or two for the first time, it can be overwhelming. If a business owner has a team of experts behind them, the sky’s the limit.

8. Credibility with financial markets

Jeff: Bringing on an institutional partner provides a lot of credibility across a number of fronts. A financial sponsor can help to be the preferred acquirer in a deal, enhance financing relationships, or get broader access to capital across debt and equity markets.

9. Opportunity to incentivize new management team members

Gina: When you have a private equity-backed company or institutionally backed company, the employees are much more interested in joining because they see the growth path. They know that this company will be successful with opportunities for personal growth.

10. An opportunity to significantly increase the value of the business in a relatively short time frame.

Jeff: There’s a pretty clear path to what privately-held businesses can accomplish with a financial sponsor partner. The goal is to make the company more valuable through infrastructure and strategic initiatives over time.

Please reach out to us at Colonnade Advisors with any questions or comments you have about this episode and if you are thinking about next steps in a transaction.