Rollover Equity: A Second Bite at the Apple

Rollover equity is a form of contingent consideration in which the sellers reinvest a portion of their proceeds into equity and ownership of the new or acquiring company. The main purpose of rollover equity is to align interests. The primary advantage of rollover equity for the selling party is it gives the owner(s) a second bite at the apple, meaning they get to participate in the equity appreciation of the combined entity. Rollover equity can usually be structured on a tax-deferred basis. From the buyer’s perspective, it ensures management is motivated and incentivized to hit their projections, and it reduces the amount of upfront cash the buyer has to fund to close the deal.

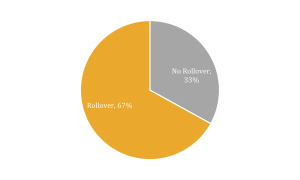

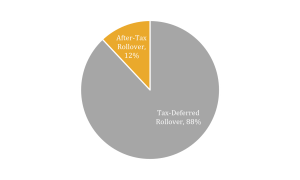

In 2019, 67% of M&A transactions utilized rollover equity. In 88% of those transactions that included equity rollover, the rollover was completed on a tax-deferred basis.

The amount of equity rollover as a percentage of the total consideration depends on many factors, including the type of buyer. Private equity buyers typically look for 10%-40% of the seller’s consideration to be reinvested in the new company, ensuring meaningful participation in the acquiring entity.

For more on rollover equity, listen to Middle Market Mergers & Acquisitions podcast episode 009: Second Bite at the Apple – Aligning Interests through Rollover Equity. https://coladv.com/podcasts/009/