In this episode, Gina Cocking and Jeff Guylay kick off their conversations around deal structure.

Once a company has been through the due diligence process (covered in-depth during episodes 003 through 006), the buyer and seller agree to a deal structure.

We learn in this episode that getting to a deal is more than just agreeing to a price.

Discussion highlights:

- Getting the best price and terms in a deal involves running a competitive sale process and the involvement of advisors with extensive industry and transaction experience. These advisors include attorneys, accountants, and investment bankers.

- Deals can be structured as stock or asset deals; and consideration can be a mix of cash versus stock.

- Consideration can include a mix of upfront or contingent payouts.

- When structuring a good deal, the sooner we start thinking about the people, the better.

- Managing the process with a focus on certainty of close is key, with advisors keeping an eye on closing the transaction in a timely and efficient manner.

Later in the episode, Jeff is joined by featured guest, Vernon Rew, a partner at Whitaker, Chalk, Swindle & Schwartz, to share his experiences advising both buyers and sellers on M&A transactions.

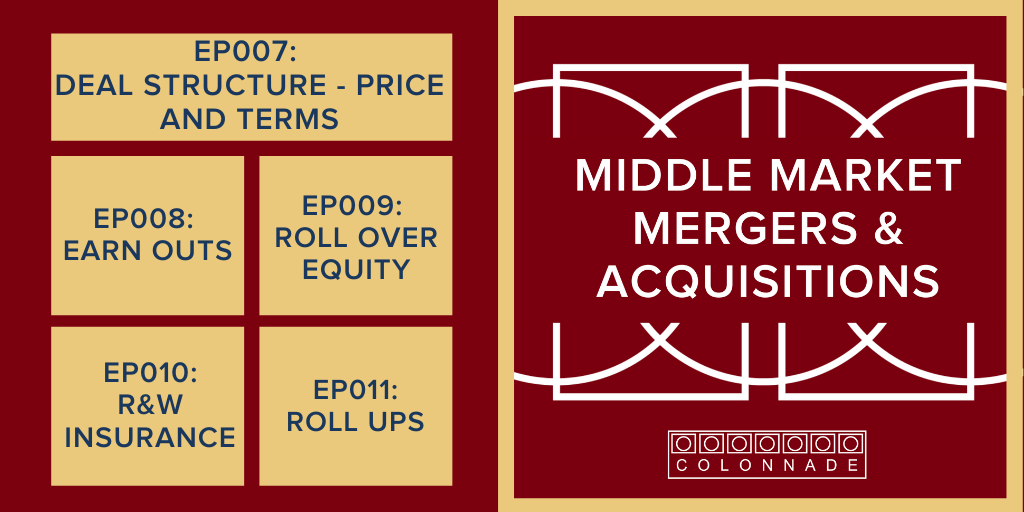

Upcoming episodes explore additional nuances in deal structure and include earn outs, roll over equity, R&W insurance, and roll ups.

In this episode, Colonnade Advisors addresses the following questions as related to deal structure:

What is the most important part of a deal structure? Are there other components to consider? (00:40)

Gina: “One of the most important parts of the deal structure is the price. We are continually reminding the sellers, especially in the early days, that there is much more than price. There are many other items that should have, in some cases, equal weight as the price.”

In terms of proceeds, what kinds of questions should a seller be considering? (01:30)

Gina: “Is it stock? Is it cash? Do they keep the debt? Do they pay off the debt?”

For the seller, what happens to the cash on the balance sheet? (03:20)

Gina: “Sellers will typically have cash on the balance sheet; usually there’s enough cash to cover outstanding checks and to pay bills. When a seller is coming up to close, and they have all excess cash on the balance sheet, that is the cash that goes to the seller at the close. Cash is used to pay down any debt that’s on the balance sheet (any loans that the seller has).”

How are deals structured? (06:15)

Jeff: “We work with our client’s tax accountants and attorneys to figure out the preferred structure. Is it a stock deal or an asset deal?”

What are the important aspects to consider as related to deal type (stock versus asset)? (06:57)

Gina: “It’s really important that the sellers have a tax review of the possible outcomes of the transaction because different structures have different tax implications.”

Why is deal consideration important? (07:39)

Gina: “When we think about the deal structure, we also have to think about the consideration. What is the seller getting? Are they getting cash? Are they getting stock in the company that’s buying them? Is that private or publicly traded stock?”

When the seller rolls over equity into a private equity-owned entity, how is valuation determined? (08:31)

Jeff: “Due diligence. Figuring out this exchange mechanism is an element of what we do in our work with seller clients.”

What are liquidity considerations if the buyer is a family office? (10:39)

Gina: “(Family offices) tend to make longer term investments. Sometimes we’ll negotiate in the deal that if a subsequent transaction doesn’t happen in (a certain number of years), the original seller has the right to sell back shares to the buyer at some predetermined multiple.”

Why do buyers offer stock in the new company to the seller? (11:25)

Jeff: “To create an alignment of interests. You want the seller to be motivated to continue to grow the firm if they’re sticking around. It’s part of risk sharing.”

What are liquidity considerations if the buyer is a public company? (12:29)

Jeff: “We do the same analysis here. It’s a little more straightforward because there are public filings. There’s a current market price posted every minute of every day. That analysis is more straight forward, but the rigor of the due diligence is still the same.”

What is the purpose of contingent consideration? (13:55)

Gina: “To align interests. Contingent consideration is (also) a way to make sure that future forecasts are hit.”

Jeff: “Sharing risk and maximizing valuation and pricing for the seller.”

What are other forms of contingent consideration besides earn outs? (16:54)

Jeff: “Another form of contingent consideration is called the holdback or an escrow. This is a separate, usually relatively small pocket of money that is set aside to indicate that we’ve made some promises about what the business is today and what it’s going to be right after closing and certainly for the first 12 or 18 months. We’re going to stand behind those promises.”

What percentage of the proceeds are typically put in a holdback or an escrow? (17:29)

Jeff: “Anywhere from five to 15 or in some cases, 20% of the proceeds are put into an escrow or hold back.”

Can escrows be avoided in a transaction? (20:01)

Gina: “The escrow can be mitigated with rep & warranty insurance.”

Rep & warranty insurance will be covered in a future episode. Please subscribe to the podcast via the links/buttons at the bottom of this page.

What should sellers be thinking about in terms of the company’s employees? (22:47)

Jeff: “There are lots of things to think about: Who is my team going to report to? Are there good reporting relationships? Who is reporting to me? (Or am I exiting?).”

What are some questions to ask about employment agreements? (22:50)

Jeff: “Who’s going to get employment agreements? How long are they going to run for? What’s the consideration? When can they fire me? What are the non-compete provisions? Non-solicitation?”

How do future growth opportunities for staff differ between private equity and strategic buyer? (23:54)

Gina: “The company is going to continue to grow through the private equity ownership period (which creates opportunities). Contribution by the staff is highly valued by the owners. Staff tends to see the potential of opportunities with a strategic buyer as being more limited. Strategic buyers are typically larger organizations and may have somebody in the organization who already does exactly what they do.”

How do employee benefits differ between private equity and strategic buyers? (24:54)

Gina: “With a private equity buyer, usually the benefits will continue, at least for a period. If it’s a strategic buyer, the sellers often have less in benefits than the buyer (so a sale can be a positive).”

When a company is selling, when do employee matters get addressed? (25:24)

Jeff: “We always try to move employee discussions way upfront in the process. Making sure that employees are taken care of is a key element of any transaction.”

What can kill a deal when selling a company? (27:37)

Jeff: “(Personnel issues). We’ve had plenty of situations where a buyer will identify a handful of key employees as mission-critical to the ongoing operations. Sometimes buyers want to have conditions in the purchase agreement that say, ‘These five people have to come across, these five people have to show up on day one and stay for a certain amount of time’. It’s up the seller to motivate them whether it’s through your relationship with them or some contingent consideration or both, but they’ve got to show up if you want to get your proceeds.”

What are other elements of certainty of close? (28: 31)

Jeff: “When we get into exclusivity with one buyer, it’s really pedal to the metal, trying to get to the finish line as soon as possible. Minimizing any conditions to close is key. We talk about the “material adverse event” or “material adverse change clause”, which is the backdoor out of a deal for both parties, but particularly for the buyer.”

What is the purpose of Material Adverse Event (MAE) and Material Adverse Change (MAC) clauses? (29:33)

Gina: “It is a way to protect the buyer or seller if there’s a material change in either business.”

What process results in the highest price for the seller? (30:01)

Gina: “A competitive process will result in the highest price and best terms in a transaction. It’s always best if we can get offers from multiple parties.”

Jeff invites Vernon Rew, partner at Whitaker, Chalk, Swindle & Schwartz, to share his experiences advising both buyers and sellers on M&A transactions.

What are the implications, opportunities, and challenges of a stock deal versus an asset deal? (31:48)

Vernon: “From the seller’s perspective, a stock deal is generally preferable. It’s also generally tax advantageous to the seller, but the tax on the transaction is a whole separate issue. The stock deal is preferable because it’s an easier deal to get done.

A buyer might prefer an asset deal. This preference may have to do with contingent liabilities and the desire to achieve certain acquisitional assets with certain designated liability.”

Featured guest bio and contact information:

Vernon Rew

Email: vrew@whitakerchalk.com

Vernon Rew has over 35 years of legal experience representing business clients in corporate matters, contract negotiations, mergers and acquisitions transactions, and securities law compliance matters. Vernon has represented both public companies and privately held entities in a wide variety of industries.

Vernon’s mergers and acquisitions practice has included representation of both sellers and buyers in a large number of transactions throughout his career. He has worked in a wide range of manufacturing and service industries in his corporate and contracts negotiating practice. In his securities law compliance practice, he has counseled clients with SEC filings, tender offers, public offerings, and going private transactions. Vernon considers himself a relationship lawyer and is an experienced counselor and negotiator on behalf of his clients.