The FAIR Framework and How to Exit Right

If you’re a founder/owner of a company, you might be asking yourself questions about next steps, especially when it comes time to think about selling your company.

Many times, the question that is on most owners’ minds is: Who is going to pay the most.

We’d like to suggest a new question, based on years in the investment banking field. We’ve helped owners create $9 Billion in value from their businesses. But we’ve done this, getting the best price and terms for a business, by asking:

What’s the right home for this business?

What’s the right home for my people?

What’s the right home for the vision?

When we interviewed Mark Achler and Mert Iseri, authors of the book Exit Right: How to Sell Your Startup, Maximize Your Return and Build Your Legacy, they explained that the term “exit” is a poor word choice. You’re not really exiting anything. If anything, it’s the beginning of a brand new relationship.

Some of the best deals we created at Colonnade involved earnouts and rollover equity, which can provide upside to the seller as long as interests are aligned.

What do Mark and Mert suggest company owners focus on?

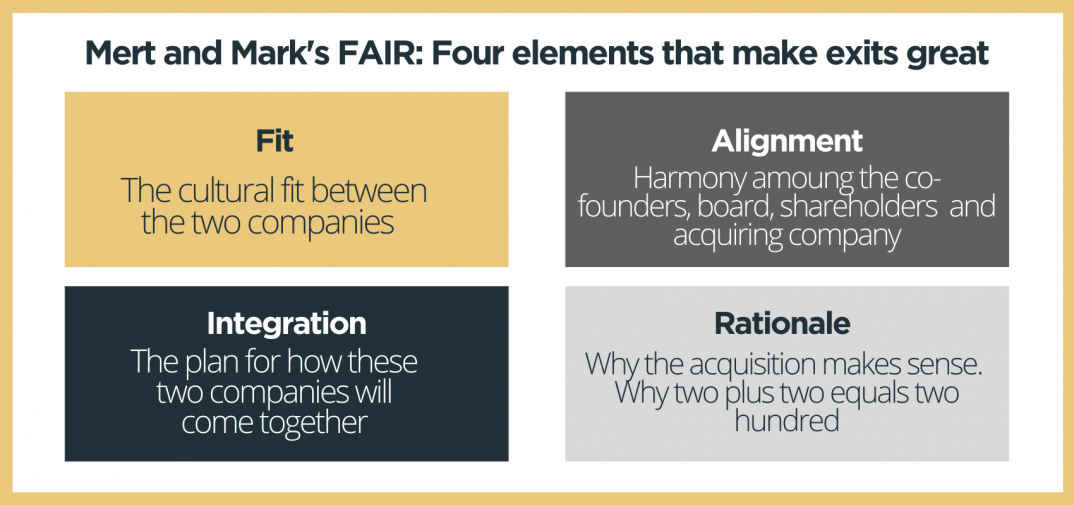

The elements of FAIR: Fit, Alignment, Integration, and Rationale.

Fit is the cultural fit between the two companies. Amazon and Zappos are a great fit. Time Warner and AOL, are probably not a great fit. It’s easily described. Can you sit next to this person for four hours and not want to kill them by the end of the meeting? Can you actually make decisions without written rules? Are cultural values aligned? Are the DNAs sort of similar, cousins to each other between those two companies?

Alignment is about being aligned with your co-founders, board, and shareholders in terms of the direction of where you want to go. The acquiring company also must be aligned.

We almost always dismiss the alignment that we need from all sides of the table. This isn’t two sides looking at each other. This is two sides looking in the same direction.

Integration has to do with the plan for how these two companies will come together. We’ve seen so many examples of this plan of integration being done as an afterthought. It’s not just product and sales integration but people integration, finance integration; many, many layers. And all of these stakeholders have different agendas that need to be individually managed.

Rationale. Can you explain to your grandmother why this acquisition makes sense? How are we going to deliver more value to our customers as a result of this partnership? How is two plus two equal to 100 in this context?

To quote Mert from the podcast interview:

“If you have all four of those, it just so happens that you’ve also found the person who’s willing to pay the most for your business because they will realize the long-term value and they’ll price the deal accordingly.”

If you’d like to listen to the full interview with Jeff Guylay, Mert Iseri, and Mark Achler, please click here.

We repeatedly say that the sooner you start the process, the better. Please reach out to Gina Cocking or Jeff Guylay to set up a discovery call that will help you think through your best next steps.