In this episode, we discuss strategic steps for Equipment Leasing and Finance companies as they grow and evolve. The leadership of these businesses may decide to remain a certain size and complexity and be “lifestyle businesses”, providing healthy cash flow to the owner(s) while they continue to run the business.

However, other options exist, and exiting the business for a favorable multiple to a bank or other buyer can be an excellent strategy, the dream plan for many entrepreneurs.

In this interview, we interview Bob Rinaldi and discuss the potential to grow and leverage a business to realize a win-win exit strategy.

This episode is a great follow-up to our previous show, Start Early & Exit Right, as we dive deep into many of the concepts of M&A rationale. What’s unique about this episode is that it is geared toward a specific target audience, our friends in the Equipment Leasing and Finance (ELF) industry.

In this episode we cover:

- How partners such as Rinaldi Advisory Services (RAS) and Colonnade work with Equipment Leasing & Finance (ELF) companies to prepare for a successful sale (1:00)

- What are the biggest challenges for the independents as they look to be “bank ready” for an acquisition? (4:00)

- What are some of the biggest challenges for banks pursuing an acquisition of an equipment leasing company? (9:30)

- What determines the level of a premium in the sale price that an ELF company can expect? (20:00)

- What has M&A activity looked like in recent years and what are the prospects? (23:00)

- What about Private Equity buyers in this space? (26:30)

How partners such as Rinaldi Advisory Services (RAS) and Colonnade work with Equipment Leasing & Finance (ELF) companies to prepare for a successful sale (1:00)

Bob: My practice has evolved around three target audiences in the equipment leasing space. About 60% of my clients are independent leasing (ELF) companies that I work with through the Confidential CEO Resource℠ model. This is multi-year exit strategy planning. Whether the company exits or not is not important. The idea is to get them from point A to point B so they’re prepared if that time comes.

The second part of my practice is working with banks, predominantly community banks who are looking to get into the ELF space.

Third, I work with a handful of service providers in the industry, as well.

Rinaldi Advisory Services (RAS) offers the Confidential CEO Resource℠ (CCR) as a robust, full-scope advisory service that provides clients with a broad base of support for long-term strategic management. RAS works with CEOs and Principals to provide meaningful analysis and actionable insights. The aim is to help ELF senior management arrive at strategic and tactical decisions geared toward managing growth as well as operational and financial efficiencies.

Colonnade has deep experience in the ELF industry. Colonnade is a leading investment banking firm that has completed over $9 billion in M&A transactions for clients in the business and financial services industries. Colonnade has advised many companies in the EFL sector on strategic transactions. Please see our Quarterly Updates on the ELF industry here.

What are the biggest challenges for the independents as they look to be “bank ready” for an acquisition? (4:00)

Bob: The biggest challenge is predominantly that these founders/owners are very much entrepreneurs. They started the business. They’re very much involved in the everyday transactional nature of their business. They don’t have the time to gain the perspective to look at their company objectively and determine what needs to happen to be a better company from a non-transactional standpoint or to be a better company for the purpose of acquisition.

Jeff: Let’s drill down a little bit on some of the biggest challenges for the independents. There’s size and scale, where are you today and where are you going? Banks are the natural resting home for specialty finance companies, and ELF companies are such a great asset class for banks in particular. Obviously, they’re a number of large independents, but from the bank’s perspective, what are the other things you see where companies need to focus? Is it finance and accounting? Is it operations? Is it servicing?

Bob: Yes. Yes. And yes. It’s really all those things. But even before you get to that, let’s look at the business and find components within the business that definitely will never, ever fit in a bank. I’m able to identify those things. You then have to decide what to do with those things. Do I jettison those things completely? Do I sell those off? Do I break it outside of the company and put it in a separate entity so that what is left is sellable and simple to understand? Compare that to a buyer looking at the company and thinking, “I like this, I like this. I hate that. Therefore, I’m not doing it [the acquisition].”

For example, say that there is a heavy services component of the (ELF) business; services component being something that has morphed, be it operational leases or servicing equipment that is leased. A bank can’t be in that business. If that is an absolute key critical component to your leasing business, then a bank buyer is probably never going to be the buyer, which is going to leave you looking at non-financial institutional-type buyers, and they’re fairly limited, so that’s a problem. That is when you look at it and go: “If that’s what we’re always going to do, then this maybe is just going to be a lifestyle business. Let’s just find ways to improve the income generation, the profitability, and keep it as a lifestyle business.”

What are some of the biggest challenges for banks pursuing an acquisition of an equipment leasing company? (9:30)

1) The banks must use experienced advisors who understand the appropriate valuation models.

Bob: If the bank has not been in the business before and their only experience with acquisitions has predominantly been buying other smaller banks, the first challenge is the valuation models. Banks are used to paying a multiple of book value. Leasing companies are not valued that way; their valuation is based on a multiple of earnings or pretax adjusted net income. In a typical leasing company, most of the leases are on a fixed term, fully amortizing type of a structure; therefore they just generate income. But the assets don’t stay on the balance sheet that long, they continually roll-off at a rapid rate, so you’ve got to keep putting on more. It’s really not an asset play as much as it is a net income play.

Jeff: When we talk to banks as acquirers of these businesses, from either the buy-side or the sell-side, you’re absolutely right. It’s all about the income-generating opportunity. Yes, there are assets associated with it, but much more importantly, it’s “What’s the potential earning stream for this business within the bank?” (See: Discover the Rationale for a Synergistic Business Merger).

Bob: That really comes down to the financial institution’s advisor, a buy-side advisor. If they’ve not had much experience in the equipment leasing space, especially current experience like Colonnade has, they’re already at a very big disadvantage because now you’ve got two entities that are blind and stating the same thing and focused on book value, so they’re getting bad advice along with their own preconceived ideas. That’s like a double whammy right out the gate.

It’s common when you find that a bank or their board, for whatever reason, have just got very comfortable with a buy-side advisor, who has never had that much experience at it but they’ve just gotten very comfortable with them and they wouldn’t even conceive of going outside. A lot of this gets really back down to, “Is the bank nimble? Is the bank flexible? Does the bank have a CEO that has cut a bigger vision?” The same thing with the board, the death of any kind of an institution is just getting so stuck in your way that you just can’t get out of it.

2) The CEO of the bank must have a visionary leadership style that allows the acquired company to thrive.

Bob: It all still goes back to the CEO of the bank and how progressive they are, how aggressive they are. And aggressive does not mean they’re careless.

Jeff: The folks that we generally work with on the banking side have made that decision. They said, “Okay, we’re going to get into specialty finance. We want to do it in X, Y or Z asset class, and we have the headset to bid accordingly, and that these businesses are valued differently than bank deals. The multiples are different, the metrics are different. We’re committed, we’ve got board approval, we’ve got senior leadership approval and we’re going to go ahead with it.”

Bob: You and I know one of the smartest, most aggressive community bankers: Chuck Sulerzyski of Peoples Bank of Marietta, Ohio. Peoples Bank is located in the Southeast corner of Ohio, squarely in Appalachia country.

How does a bank that size, originally ~$1 billion in assets when he took it over and roughly $7 billion today, make such successful leasing company acquisitions? One located in Vermont and one located in Minnesota? If you take a look at the numbers, the ROA and ROE of the bank have improved dramatically. Their yields and spreads have increased dramatically. Their asset growth has increased significantly in the commercial real estate (CRE) and in the commercial and industrial (C&I) sectors. His shareholders are being rewarded handsomely and will continue to be.

Jeff: Chuck sets a great example. He has been aggressive in good ways. Peoples Bank also acquired an insurance premium finance company, and they’re diversifying.

Chuck has the right headset in that he looks to acquire businesses to expand and diversify their geographical footprint. That’s a real success story, in my view.

Bob: If you’re going to acquire a leasing company that’s growing, that’s used to growing assets, the last thing you want to do is turn them into a bank. That’s the whole premise for why you’re going to buy a leasing company – is to expand the scope of the bank, not to contract it. It requires an introspective look of the CEO and his team: can they make an acquisition and not micromanage it and end up turning it into a bank?

3) Banks must be able to create objectives around diversification of geography and asset classes.

Bob: Equipment leasing is not a geographic-specific industry unlike, let’s call it, commercial real estate. Banks are very familiar with commercial real estate. Real estate is always local. Commercial real estate is local, you’ve got to know the geography that you’re in very well so that you understand the commercial real estate in that market.

Banks must understand what they’re trying to achieve in three to five years in terms of what percentage of their (Commercial and Insurance) C&I assets they want in various sectors. How much do they want to get to in ELF? What do they want it to look like in three years, four years? Depending upon how big that number is, that determines the modality of the type of equipment leasing business you could get into. There are multiple facets to the equipment leasing industry: 1) small ticket, (transactions less than $250,000), middle-market/mid ticket (up to $5 million per transaction size), and large ticket (above $5 million per transaction).

Jeff. Take Wintrust. They’re not really “a bank”. More than 40% of their loan portfolio is insurance premium finance. They’ve got a big equipment finance business on top of that. There’s probably 50% to 60% of loans that are non-traditional banking assets. As a result, the ROA on that bank is considerably higher than its peers; and as a result, the stock trades higher.

And Peoples, as we’ve discussed, has the right headset that they need to acquire or look to acquire national platforms outside of Marietta, Ohio. Obviously, they’ve done some bank acquisitions too in footprint, but expanding to get national business is part of the CEO’s strategy.

What determines the level of a premium in the sale price that an ELF company can expect? (20:00)

Bob: It falls under the quality of earnings, platform, and quality of human resources.

- Quality of earnings: I think about the repeatability of the earnings, as opposed to having a trend line of earnings that is a sawtooth (up and down, up and down). Quality of earnings should be fluid and show continued ramped-up growth over a period of time.

- Platform: The ability to scale. What’s their technological capability? What’s the platform built off of, is it homegrown? Is it well protected? Is it SOC compliant? If you had more capital, can you scale it?

- Quality of human resources: What does the management team look like? What’s the average age of the team? What are their qualifications? What does the core management team look like behind them?

If you cover all three of those pretty darn well, you’re going to get the higher end of the premium scale for sure.

What has M&A activity looked like in recent years and what are the prospects? (23:00)

Bob: Activity’s been strong for the past few years. Part of the activity was exacerbated when everybody thought that in 2021 there was going to be a new tax act and capital gains were going to go up. The biggest reason over the past four to five years is because you’ve got an aging-out (in the midst of the Great Resignation) of the Principals of these companies. It’s just a normal progression, and it happens every five years or so. You get a number of individuals who have had their own leasing companies who started them 20 odd years ago. If they started 20 years ago, here we are 20 years later, they’re in their mid-60s to late 60s. If they don’t get out now, when are they going to exit? Because typically there’s going to be an earn out. If you wait till the age of 70 to get out, you may be working on an earn out between the ages of 70 and 73.

On top of that, there’s the aspect of an ELF company having a capital constraint. At some point, their capital is not going to hold them to keep borrowing on their line of credit because the debt-equity ratios will get too high and they’ll have a hard time borrowing. It’s really at about that time when they have to start thinking about what’s next. Do we bring in another equity partner? Do we bring in some sub-debt? All that does is kick the can down the road. And I always tell them at that point: “You’re already selling part of the company. Just sell the whole thing.”

Listen to this podcast episode/read through the shownotes to see the Four Reasons Company Owners Consider a Transaction (15:25)

What about Private Equity buyers in this space? (26:30)

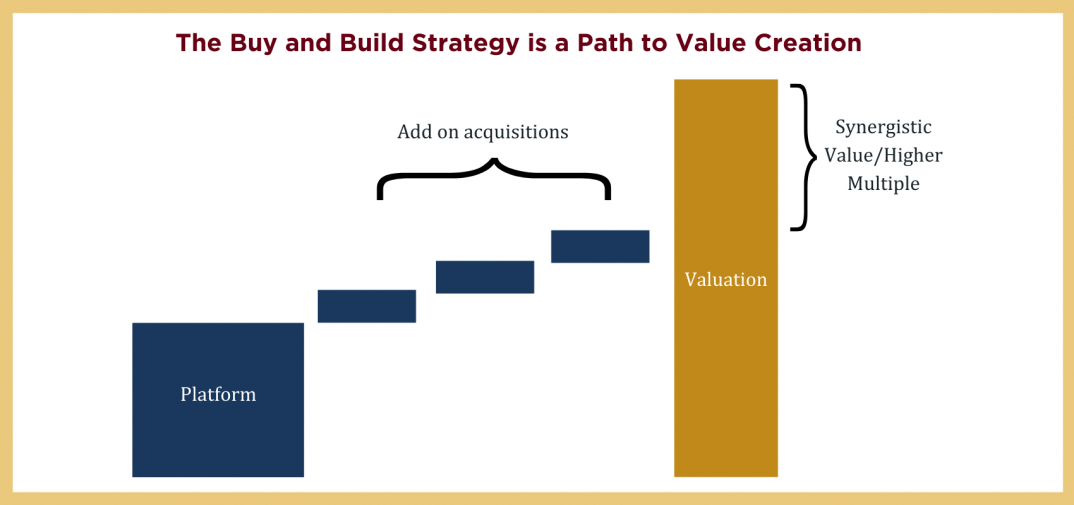

Jeff: We regularly get calls from folks looking to find platforms to acquire and build upon. There are some opportunities there: To remain independent, nimble, and flexible outside of the bank model, and take in additional capital to grow and potentially enhance the financing capabilities through securitizations and others.

Bob: The equipment leasing industry is a fairly mature industry. It’s fairly sophisticated. For an independent leasing company to bring in private equity, I see that as only a solution if you don’t believe you’re able to sell the whole company right now. The PE firm is investing to get double-digit returns, so that means they’re going to come in and put you (as the owner/operator) on a huge ramped-up treadmill. You are going to have to keep up or they’re going to lose interest. And you’ve sold part of the company.

Now, granted, you’ve got a smaller piece but now have a bigger pie.

Jeff: That makes sense. There are some examples of successful private-equity-backed equipment finance companies, but as we have found – the universe of financially oriented sponsors that really want to put a lot of capital into the business and are willing to wait a long time to get their return – is quite limited. Most folks attack it from the financing standpoint. It can be a good option if you have an aging founder that wants an opportunity to take some chips off the table and let the next generation continue to run it. But you’re right, it is a different exercise being put on that treadmill.

Bob: It’s a much different exercise. On the other hand, where it does work really well, is when a PE firm is backing a very experienced individual or a team who is going to start up a new entity. They could start this new entity and scale quickly with the help of private equity. They’d have a chance to really leverage that with some serious growth. Then it makes complete sense.