Colonnade Advisors’ Podcast Series Answers Your Questions About the Best Process for Selling Your Company

You’ve grown your company to a successful enterprise and feel that it is time to take some of your chips off the table. Perhaps the hot M&A markets and favorable multiples suggest that now is the time to look for exit strategies that fit the goals of the founder and management team.

However, you likely have dozens of questions swirling around such as:

- When is the right time to go to market?

- How long does the process take?

- What type of process yields the best outcome?

- How do you manage the situation internally with employees who may not know the company is being sold?

- What are some pitfalls to avoid?

- How does one pre-qualify potential buyers?

- What are best practices for documentation, such as nondisclosure agreements (NDA), confidential information memorandum (CIM), indications of interest (IOI), letters of intent (LOI), etc), and who prepares them?

- What is an electronic data room and why is it so important to set this asset up correctly?

- What is the best way to prepare for management team meetings?

- How do you get the best deal terms AND price?

To answer these questions and more, Colonnade Advisors’ Managing Directors Gina Cocking and Jeff Guylay put together a series of podcast episodes to walk you through the process of selling your company, step by step.

We’ve also invited a CEO who has recently been through the process herself, Elizabeth Davies of Stonemark, to share her experiences of what it is like to sell her company successfully with Colonnade.

Some highlights covered in our four-part podcast series include:

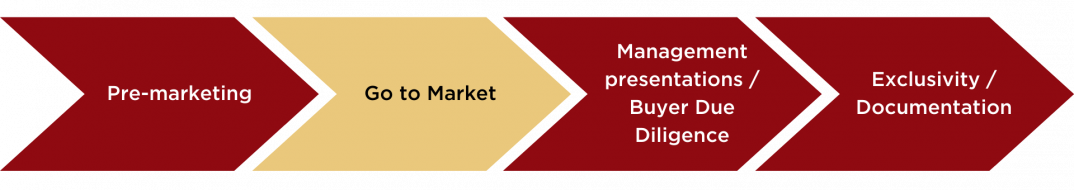

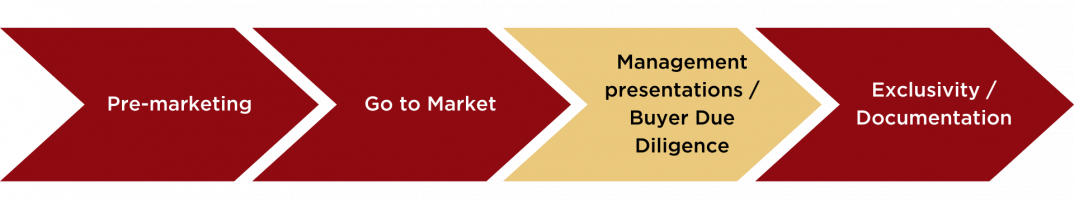

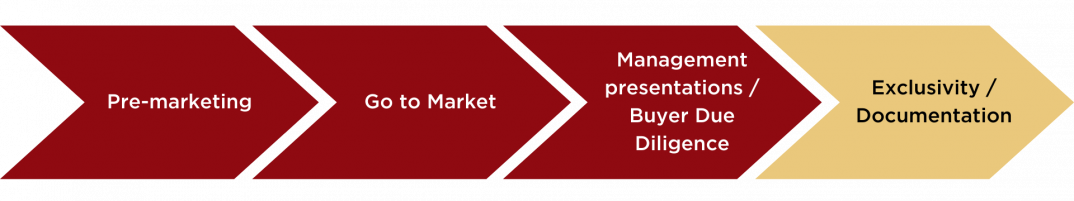

• In EP001, Pre-Marketing, Gina and Jeff outline Colonnade’s process for a typical sale transaction with four phases:

1) Pre-Marketing

2) Go To Market

3) Management Presentations / Buyer Diligence, and

4) Exclusivity / Documentation.

These four phases can go by as quickly as 16 weeks, depending on how prepared the company is.

• CEO Elizabeth Davies describes the sales process as if “baking a cake”. The business makes the cake, and the investment bankers (Colonnade) put the icing on it. Only then is the business (cake) ready to be presented for sale.

• Davies discusses the process of understanding the company’s true market value.

Phase One: The first phase is the pre-marketing phase. Colonnade, as a sell-side advisor, performs an in-depth analysis of the company to ensure a complete understanding of the business and addresses any potential issues. Phase One prepares the company to be in an optimal position to go-to-market.

• In EP002, In the Market, Gina and Jeff focus on key steps related to the second phase, Go To Market. Key concepts discussed include the Confidential Information memorandum (CIM), dataroom, and getting the most informed bids for the company.

• CEO Elizabeth Davies shares how much can be learned about one’s self and others during the process of selling the company.

• Davies provides advice to other CEOs in terms of balancing focus on the business itself vs. the transaction.

Phases Two through Four are the “In the Market” segment, in which we’re interacting with buyers or investors on your behalf and working our way expeditiously through investor calls, due diligence and documentation.

Phase Two: Go-to-market, involves Colonnade formally contacting potential investors or buyers of the company. Colonnade may contact up to 100+ potential investors or buyers, all of which have been approved by the client, depending on the situation and the objectives of the seller. Colonnade uses the information gathered in Phase One to answer the majority of the questions asked during this phase, letting the company’s management team focus on running the business.

Once interested parties have an NDA in place, we share the Confidential Information Memorandum, a compilation of the history of the company, an overview of the team, the industry outlook, and the growth prospects. Colonnade solicits written indications of interest to determine which investors or buyers are genuinely interested and ready to commit.

In EP016, Management Meetings, Gina and Jeff answer questions including:

• What purpose do management meetings serve?

• What topics are covered during management meetings?

• Who is invited?

• What’s the format for a successful management meeting?

• How has COVID19 changed how management meetings take place?

• How do we best prepare our clients?

Phase Three: Management Presentations / Buyer Due diligence. This phase begins with the company’s management team meeting with a limited group of qualified potential investors or buyers. This is an opportunity for the management team to get to know the interested parties, too; both sides ultimately need to be comfortable working with each other going forward. During this phase, Colonnade opens a secure electronic data room for the interested parties to review materials. At the end of Phase Three, Colonnade asks for this select group to submit final written bids, often accompanied by a markup to the draft purchase agreement.

In EP017, Exclusivity, Gina and Jeff answer questions including:

• How does a company prepare for the shift of power from seller to buyer?

• Why are the letter of intent (LOI) negotiations so key?

• How do you select the winner (while keeping others warm in the background)?

• Who’s involved during the exclusivity and documentation phase?

• How long does this phase take and how much does it cost?

• What are some pitfalls to avoid, and how can Colonnade mitigate risks for the seller?

Phase Four: Exclusivity / Documentation. After reviewing the final bids, the company, with Colonnade’s guidance, selects the winner. Once the investor or buyer is selected, they conduct final due diligence. With Colonnade’s ongoing support, attorneys work to negotiate the purchase and employment agreements. If applicable, a reps and warranties insurance policy is put in place after final diligence is complete.

We invite you to download our 16-week sales process timeline to see how Colonnade Advisors typically approaches the process of selling a company. Having a defined process and timeline in place is critical to ensuring a successful transaction.

Memorable takeaways from the four-part podcast series include:

Colonnade brings a process-oriented approach to each deal to help each of our clients navigate this challenging yet exciting process.

Recent sell-side transactions