Before you sell your company, even the odds.

This episode features guests Mark Achler and Mert Iseri, authors of the recent book, Exit Right: How to Sell Your Startup, Maximize Your Return and Build Your Legacy.

Exit Right demystifies how to conclude the startup journey, a perfect complement to our podcast, which focuses more on the exits of larger middle-market companies. As Brad Feld states in the Foreword, “Mert and Mark set the roadmap for how entrepreneurs and business owners can proactively manage the process of getting to a successful exit along the way.”

As Jeff says at the start of the interview: Mark and Mert cover so many great informative topics in the book. There is a wealth of tips to guide business owners through what can be a tumultuous process, getting through the exit. There are also so many topics we align with: relationships matter most, planning for wealth, time kills all deals, and the importance of following a best-practice process.

In this podcast episode, we focus on three topics with a lot of meat to each:

- FAIR, Mert and Mark’s framework for a successful exit (3:00),

- The ”Exit Talk” and how we suggest that all companies adopt this practice with their board (15:00), and

- Who is involved in the Exit Talk and why? (28:00)

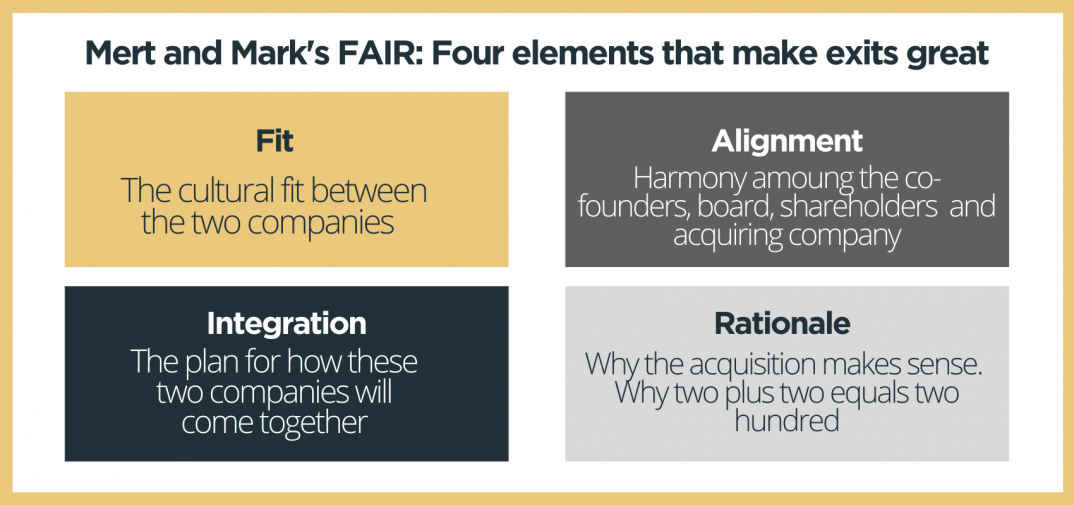

What is FAIR? Why does it lead to the best transactions? (3:00)

Mert: What we realized as we started to gather stories and experiences from M&A bankers, lawyers, serial entrepreneurs, etc is that the real question isn’t, “Let’s find out who’s going to pay the most.”

The real question is, “What’s the right home for this business? What’s the right home for my people? What’s the right home for the vision? Who is going to serve our customers the best?”

Our view of an exit went from being a short-term transaction to a long-term partnership. The term “exit” is a poor word choice. You’re not really exiting anything. If anything, it’s the beginning of a brand new relationship. So when we ask ourselves, “What makes a great home for a startup?” we focus on these four elements that make exits great.

FAIR. Fit, Alignment, Integration, and Rationale.

If you have all four of those, it just so happens that you’ve also found the person who’s willing to pay the most for your business, because they will realize the long-term value and they’ll price the deal accordingly.

Fit is the cultural fit between the two companies. Amazon and Zappos are a great fit. Time Warner and AOL, are probably not a great fit. It’s easily described. Can you sit next to this person for four hours and not want to kill them by the end of the meeting? Can you actually make decisions without written rules? Are cultural values aligned? Are the DNAs sort of similar, cousins to each other between those two companies?

Alignment is about being aligned with your co-founders, board, and shareholders in terms of the direction of where you want to go. The acquiring company also must be aligned.

We almost always dismiss the alignment that we need from all sides of the table. This isn’t two sides looking at each other. This is two sides looking in the same direction.

Integration has to do with the plan for how these two companies will come together. We’ve seen so many examples of this plan of integration being done as an afterthought. It’s not just product and sales integration but people integration, finance integration; many, many layers. And all of these stakeholders have different agendas that need to be individually managed.

Rationale. Can you explain to your grandmother why this acquisition makes sense? How are we going to deliver more value to our customers as a result of this partnership? How does two plus two equal 200 in this context?

Mark: There are profound financial implications to the FAIR framework. Let’s take Integration. Integration is the ugly stepchild. People always say, “Oh yeah, we’ll deal with integration afterward.”

Turns out that in many transactions, it’s not always 100% cash. Sometimes there’s an earn-out for future performance. If you’re not integrated well (you don’t have the resources you need to execute your plan), there are some significant financial implications to the earn-out.

Then there are the financial implications to Rationale. Transactions are typically based on looking backward using a multiple. When you create a rationale that says one plus one equals a hundred, if it’s a strategic investment, you take your product and we plug it into the larger company’s sales force or the larger company’s customer base. What could we do inside the larger company?

What’s the impact of your product on the larger company? The way to maximize value is not looking backward as a multiple, but looking forward using the rationale. Strategically, why is the combination so valuable? If you can get everybody aligned around the rationale and the financial implications of that rationale, that’s how you’re going to drive a better price for an exit.

Mert: No one’s going to just sit down and tell you, “This is our rationale.” You uncover it. You unearth it over years. That’s why we urge entrepreneurs to put their party dresses on. Talk to many competitors. Talk to strategics. Get out the door.

You need to build this trusted relationship over time with fundamental questions.

How can I help?

How can I help you push your agenda forward?

How can I help my customers?

This is what great partnerships really look like. We’re not saying go share your financials with your competitors or give away all your IP to a larger strategy, but you need to be that trusted partner that advances the mission on all sides and creates a situation where everybody wins.

Mark: We wrote the book about exits, but it turns out that the decisions that entrepreneurs make at the beginning of their journey have an outsized impact at the end of the journey. Even though this book is really about the exit, there is really good advice there about the beginning of the journey as well.

Jeff: That’s exactly right. This book is really about the journey. All of the steps on the journey influence the end. There’s so much wisdom in the book and insights about all the things that you can do to proactively get to the right end. Management meetings are oftentimes the first time that business owners meet their potential acquirers, whether they’re competitors or strategics, or investors. But the longer that relationship can be developed, the more that you can uncover in terms of the shared common goal of what can we do together. And the best valuation and the best terms will just naturally evolve.

What is an “Exit Talk”? How can founders use it to reach alignment in their boardrooms? (15:00)

Jeff: The Exit Talk really struck a chord with me. Let’s encourage clients and future clients to have these discussions and this thought process through the FAIR framework to really think ahead.

Sometimes we as investment bankers get brought in late in the game. But most of our transactions and our best relationships really span years. We get to know the business, the goals, and importantly the people involved, the operators, the owners, the founders, and the investors. Some of these relationships for us span a decade or more. We give them advice on how to grow their companies.

This concept of an exit talk is missing from my perspective. Exit discussions are often secretive or clouded in secrecy. It is a very small universe of folks within a company that knows that a transaction is imminent. It’s rarely discussed openly among the senior leadership team until late in the game.

What you guys propose is proactive. Through your work and sharing your work with my future clients, I’d like them to embrace this philosophy.

I love this quote that you said, “Instead of fueling the awkwardness of the exit topic by staying silent, we are putting forward a new norm that we believe the entire industry should adopt, which is the Exit Talk.”

Mark: This is one of our favorite topics. But before we dive into the Exit Talk: We are such big believers in trust. Every deal has its ups and downs. It has its emotional turbulence, it’s the journey. Trust is the lubrication that gets deals done through to the conclusion. I just wanted to put a fine point on that topic of trust because it permeates everything we do.

The Exit Talk.

It turns out that there’s a stigma to talking about exits. CEOs are afraid. They’re afraid that if they bring up the topic of an exit that their board and their investors are going to think their heart’s not in it. They’ve lost hope. They’ve lost faith.

In the Venture Capital or Private Equity world, we have a time horizon. When you take our capital, you take our agenda, and you take our time horizon. We’re looking for X return over Y timeframe. And if you’re in year one of a fund, we’ve got plenty of time. Let’s go build and grow. If you’re in year 10 of a fund, we’ve got to start returning capital back to our LPs.

With the Exit Talk, what we’re proposing is that once a year, maybe your first board meeting of the year, you have a regularly scheduled annual talk where the CEO, without fear of being perceived as their heart’s not in it, can talk about the exit.

The reason it’s so incredibly helpful is that you have the luxury of time. If you had 18 months or two years, you have the luxury of saying, “Who’s going to be the most likely acquirer? Is it going to be a strategic acquirer? And why? Who is it and why would they want to acquire us? Or is it going to be a financial buyer and what are they looking for? Are they looking for top-line revenue?”

If we’re going to sell to somebody who really cares about growth, we may invest a little bit more heavily in sales and marketing. If it’s somebody who is more financially oriented and really cares about EBITDA, we might tighten the ship and focus on profitability.

It gives you the luxury of time to get your intellectual property in order, make sure that every single employee has a signed agreement, and make sure that trademarks and patents are filed appropriately. Get your data room pristine. If you have the luxury of time, you can optimize and present your business. And you could take the time to find the best bankers and attorneys who really are going to represent you well.

Mert: An outcome of this talk doesn’t necessarily have to be “we’re ready to sell, or we’re not ready to sell”. It can also be an opportunity to start prototyping some of the theories around how you add more value to your customers. This is a great centerpiece for what we believe an exit should be reasoned around. This will help our customers faster/better than what we could do on our own by just raising more money or gathering more capital or resources.

For instance, if you are going to have a strategic alignment with a larger company like Google, but you’re not ready to sell, it’s still an opportunity to start a relationship. Maybe we work on a mutual customer together. Maybe we create some content together where we tell our stories and we share our wisdom with theirs. You want to start charging up that trust battery over time. When you are ready, you are a known entity.

The reality is these M&A (Corporate Development) leaders want to buy companies from trusted entities. They don’t want an egg on their face either. They want to know the company that they’re investing in. They’re not viewing this as an acquisition, they’re really viewing it as an investment. They want to know they can trust you. They want to know that you can go the distance.

It’s a really difficult thing to do to create that kind of trust. You’re not going to rush through trust. You’re going to build it incrementally over years. Even the identification of a strategic partner when you’re not ready to sell is extremely valuable because that’s an opportunity to generate a relationship. Find out what their priorities are. See if your solution helps move those numbers forward.

Mark: We’re big believers in empathy. We have an empathy framework. There are three rules of empathy:

1) It’s not about you. It’s always about the person sitting across the table from you.

2) Do your homework. Deeply and truly understand what’s important. Mert just said, “Go listen to the quarterly earnings report.” They’re going to tell you what they care about.

3) Bring a gift, add value. When I say bring a gift: what can you do? If you’re an industry leader, provide some thought leadership about where the market’s heading. Share new bits of technology. Not only can you gain knowledge about their strategic direction, you can also share knowledge and be thought of as a trusted thought leader.

If you take those empathy rules and apply them to building relationships over time, that’s how you’re going to earn trust.

Jeff: I love the idea of a trust battery and charging that up over time. You can’t do that overnight. You can’t do that in one management meeting. You can’t do that in a really compressed timeframe. You really need to start early and think about what you can bring to the table. What can you bring as a gift to add value to somebody else so that they can see the value in what you are bringing?

That’s really the roadmap that you guys layout in your book: what steps can we take proactively to get to the best outcome.

Who is involved in the Exit Talk, and why? (28:00)

Mark: Let’s separate out the annual exit talk from an actual transaction process. The exit talk is a board of directors-level conversation. Maybe you bring in one or two top lieutenants into that conversation, depending on the relationship between the CEO and maybe one or two C-suite members. But that’s a board-level, strategic conversation that’s not for the whole company.

(For an actual transaction process), there are lots of different ways of handling it. My own personal opinion is that there is a dance that takes place starting as an aperture that broadens over time. One of the challenges with telling any employee about a transaction is human nature. “What’s that mean to me? Am I going to have a job? Am I going to get fired? Am I going to become rich? What are my stock options worth?”

One of the challenges is that not all deals happen; deals fall apart all the time. So the team has to have their eye on the ball. For the CEO, when they’re going through a transaction, it can be all-consuming. We’ve seen instances where companies started slowing down, missing their numbers because the CEO was distracted and not focused on running their business.

The way I think about it is starting with the CEO and the board, keeping a really tight circle of information. And then as the conversations start to broaden and deepen in a transaction, then people are going to start the due diligence process.

Make sure your C-suite is involved and your executive team is involved. The people who are going to be part of the due diligence process, obviously you’re going to have to inform them. I don’t think it’s a great thing to just wake up one morning and say to your entire employee base, “Hey, guess what? We just got sold.” There’s a middle ground someplace in that continuum. Try to keep it confidential through most of the process. As you start to get to certainty you need to start opening it up so it’s not a surprise to everybody.

Mert: There’s one major stakeholder that hasn’t been discussed and I just want to bring that up, and that’s your family. Most founders overlook that and think of this transaction as a business event. This is a life event.

Your family is a humongous stakeholder. We want to highlight that this is a critical component of whether an exit happens or not. What’s happening with your family is just as important as what is happening with your board and other stakeholders.

Mark: I couldn’t agree with you more. It’s not just us, it’s our families and our loved ones too that have a stake in this.

Jeff: It goes for all key constituents, starting with the family and then moving down to the board members and the C-suite and figuring out what’s the right communication style and method and frequency. These things are really critical decisions that most folks don’t really spend the time thinking about.

Mark: One of the questions we ask CEOs is: when you’re done with the transaction, will your employees come back to work for you in the next company you start? Will your investors want to invest in you in the next company you start? Will the biz dev lead of the large company who goes on to the next company, are they going to want to buy your next company?

I think what many entrepreneurs fail to understand is that the relationships you build and your legacy live on way past the deal and the transaction.

We’re big believers in servant leadership and that the best CEOs don’t view life as a zero-sum game. They make sure that they take care of their customers, their employees, and their investors. They try to find the balance of supporting all relationships over time.

We promised a link to a form for founders interested in a conversation and a copy of our guests’ book.

ABOUT OUR GUESTS

While a successful entrepreneur may exit a handful of companies in their lifetime, large buyers close deals all the time. Without decades of experience in mergers and acquisitions, founders don’t have the tools they need to get the best results for themselves, their teams, or the new parent company.

Through dozens of interviews with M&A leaders at the biggest Silicon Valley acquirers—as well as attorneys, bankers, and founders who have been through the trenches—Exit Right delivers the hard-earned lessons that lead to successful exits. From negotiation to valuation to breaking down a term sheet, managing legal costs, and handling emotional turbulence—this unparalleled guide covers every critical aspect of a technology startup sale.

Learn where deals get into trouble, how to create alignment between negotiating parties, and what terms you should care about most. Above all, learn how to win in both the short and the long term, maximizing your price while positioning your company for a legacy you can be proud of.

Author Biographies

An early employee of Apple and Head of Innovation at Redbox, Mark Achler has been creating and investing in tech startups since 1986. Today, he is a founding partner of MATH Venture Partners, a technology venture capital fund, and an adjunct professor at the Northwestern Kellogg School of Management.

Mert Iseri co-founded SwipeSense, a healthcare technology company acquired by SC Johnson in 2020. Prior to that, he co-founded Design for America, a national network of students using design thinking to create social impact, now part of the IBM Watson Foundation. He is currently an Entrepreneur in Residence at MATH Venture Partners.

Additional Links

Connect with Mark Achler on LinkedIn

Connect with Mert Hilmi Iseri on LinkedIn